Secondaries and liquidity: The investor’s access and the founder’s dream

Zuhair Shamma is the co-founder of UAE-based Zest, an equity management platform

Have you ever wondered why we were able to invest in SpaceX via a secondary transaction but not in a later-stage startup from the Middle East and North Africa (Mena)? Why is it that more developed markets have founder and employee partial liquidity solutions, but over here we are stuck debating on their value? Crazy!

After making a few startup investments, my co-founder Rawan Baddour and I began to realise that early-stage investing was a privilege and the road to financial returns requires tonnes of patience. Eventually, as we tried to find ways to sell some of our holdings, we started discussing the concept of liquidity and the eagerness to begin converting some of our successes to cash. Needless to say, it was very difficult and triggered our passion to build Zest.

As we set on our journey, we spoke to more than 100 ecosystem stakeholders, from founders and their teams to VCs and their LPs. What we found is that, yes, illiquidity is a growing issue in our markets and it is starting to adversely impact our ecosystem: founders and VCs at times may feel pressured to chase an exit event to return capital to their investors, startups are no longer able to retain their rockstar team as team members seek higher wages to support their families and investors are not able to meet their short or medium term liquidity needs because their capital is locked-up.

There is a clear need for a transparent secondary market in our venture ecosystem as it creates various opportunities including:

-

Providing access for new investors who would like to participate in successful later-stage startups

-

Generating returns for existing investors and VCs, which could in-turn be recycled back into other opportunities in the ecosystem

-

Allowing founders and their teams to pay for life events and for startups to retain talent and achieve their overall long term vision

-

Zest was born out of the need to solve these issues

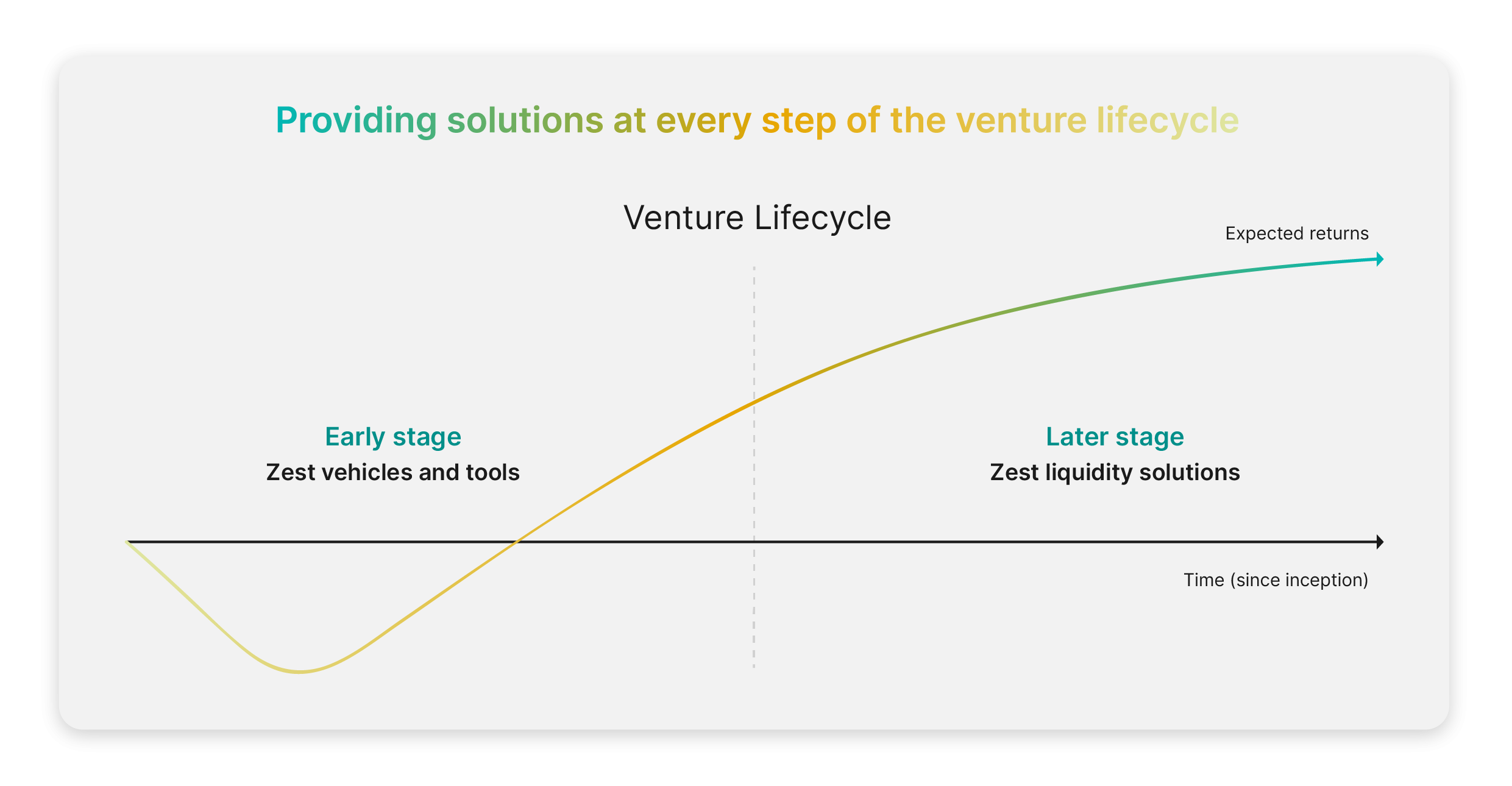

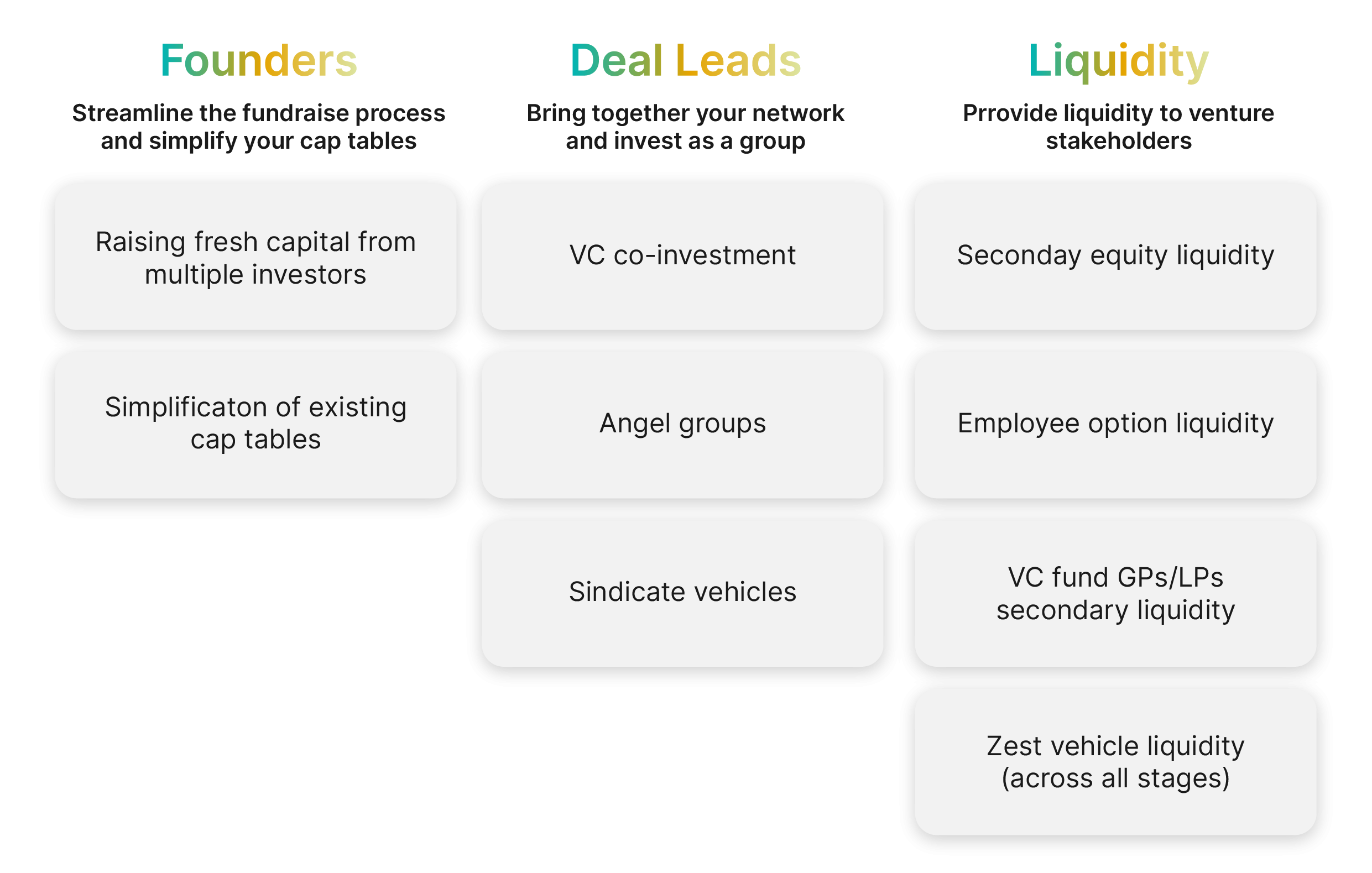

In fact, what we realised is that venture investing as a whole needs to be standardised and in turn, we are building the digital and legal infrastructure to do so. In addition to secondary transactions, founders started to use our platform to run their fundraises and simplify their cap tables, deal leads launched their syndicates and VCs used our platform for their co-investment deals - it turns out that, the market also needs a localised solution for venture transactions and so we built a first iteration of the platform that allows for this.

Put simply, the gaps were as follows:

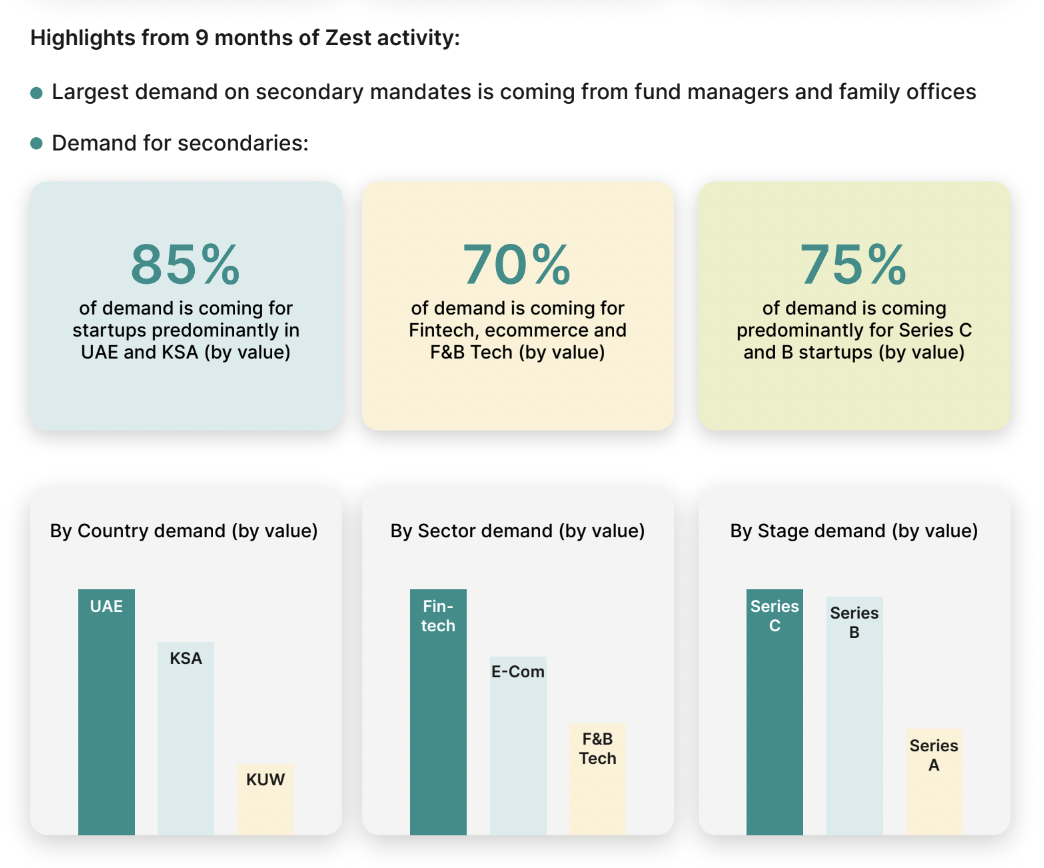

Today, and over the last year, Zest has become a platform that standardises venture transactions for all stakeholders, simplifying the transaction process with multiple use cases, and it’s working - our users have transacted more than $7m alongside some of the most reputable VCs in the region and beyond. To add more colour to our journey so far, we’ve pulled some interesting highlights that paint an exciting jump-start to what the secondaries market on Zest looks like so far.

Across emerging markets, a successful secondaries marketplace levels the playing field for all venture stakeholders - whilst standardising transaction processes at every step of their journey. Of course, it is not going to happen overnight, this will take time, but it is crucial that we continue to build the tools and offerings to enable frictionless transacting for all parties involved, solidifying our growing venture ecosystem.