Mena startups raised $35.6 million in June, pushing half year total to $1.6 billion

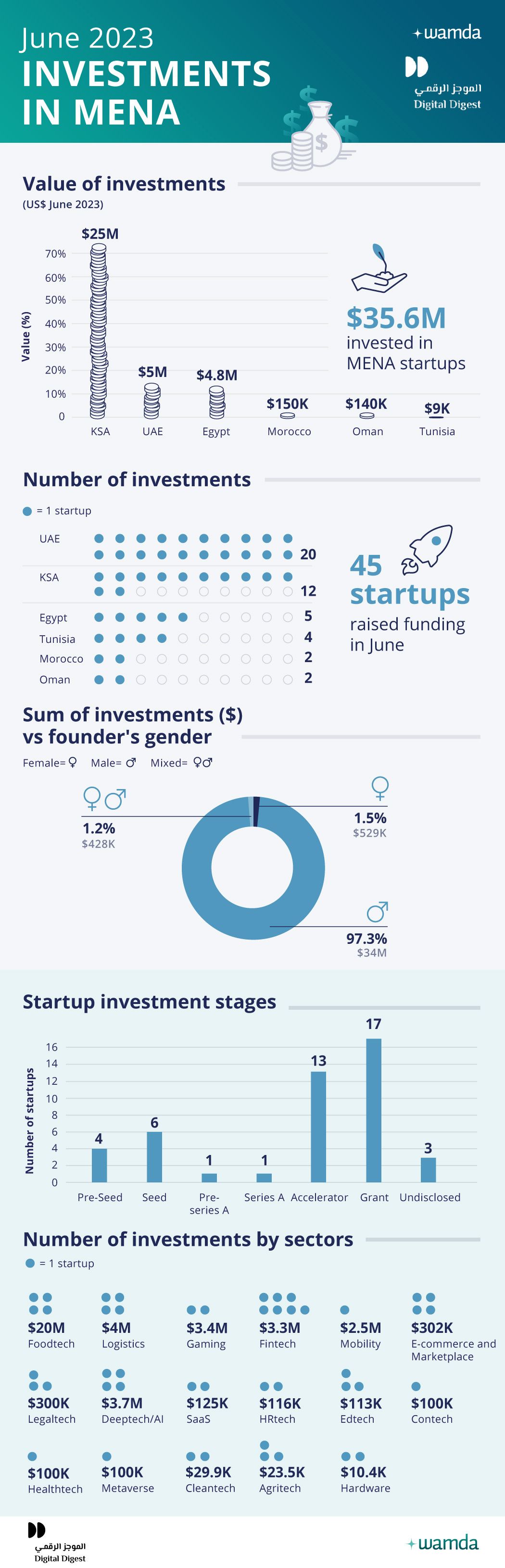

Startups in Mena raised $35.6 million in June 2023 across 45 deals, pushing the half year funding total to $1.6 billion.

While May was a bounceback month for investment in the region, June has been less dazzling, marking a 92 per cent decrease month-on-month. However, if we exclude Tabby’s $350 million debt financing round announced in May, then this monthly decline falls to 62.5 per cent.

Saudi Arabia ranked first in terms of the funding value with $25 million across 12 rounds. UAE was a distant second, with its startups attracting $6 million spread over 20 rounds. Egyptian startups were the third largest recipients of capital thanks to Egypt’s trucking marketplace Trella’s $3.5 million round.

Sector-wise it was fintech that attracted the most number of deals with seven startups raising $3 million, but it was the foodtech space that secured the most funding with just over $20 million raised across four startups, accounting for 56 per cent of the total raised. Other sectors that gained investor attention were logistics, e-sports and mobility.

Late-stage venture capital activity witnessed a major slowdown, as well-capitalised startups continue to be frugal with spending and conserve cash amid a tighter fundraising environment. Seed and pre-Seed rounds were not insulated from the funding crunch. In fact, June’s fundraises were dominated by grants and accelerator funding and it was due to this that nine female-founded startups managed to secure investment, compared to just one in May.

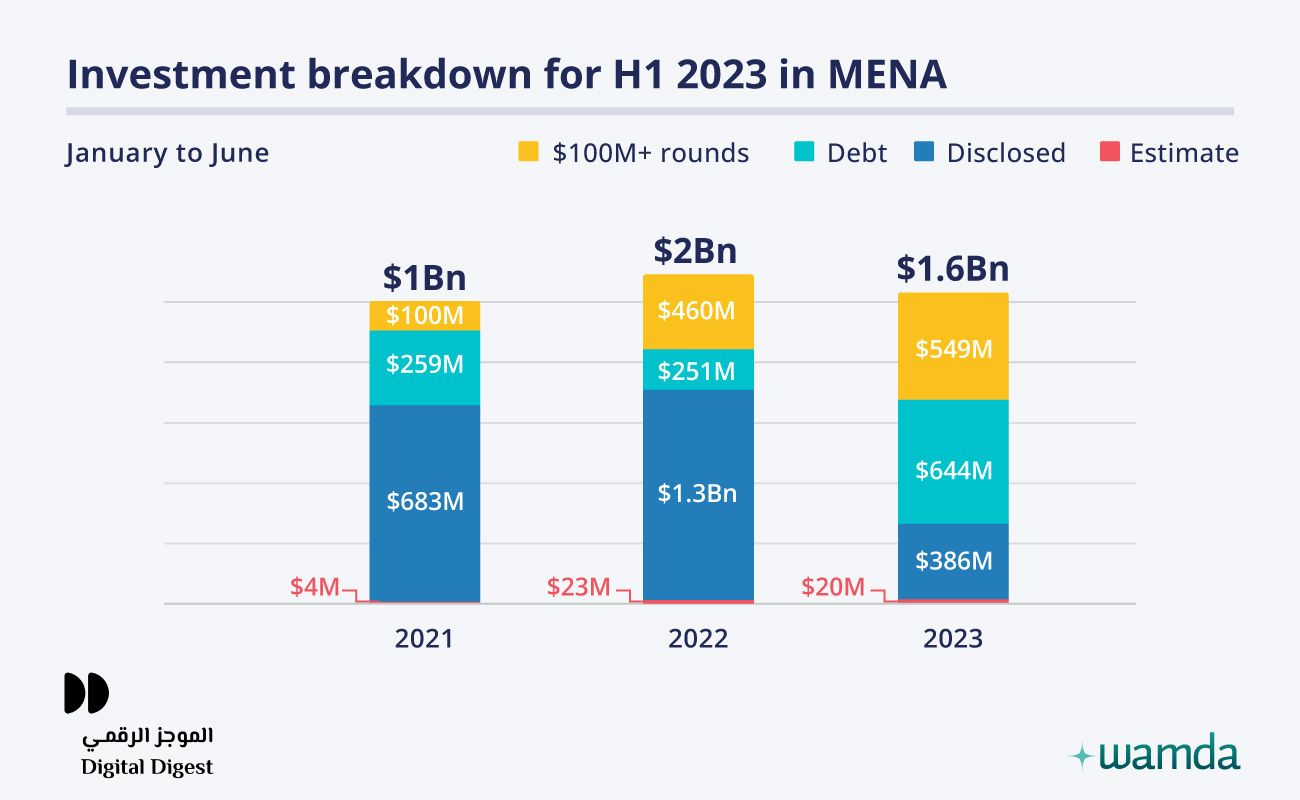

January to June 2023

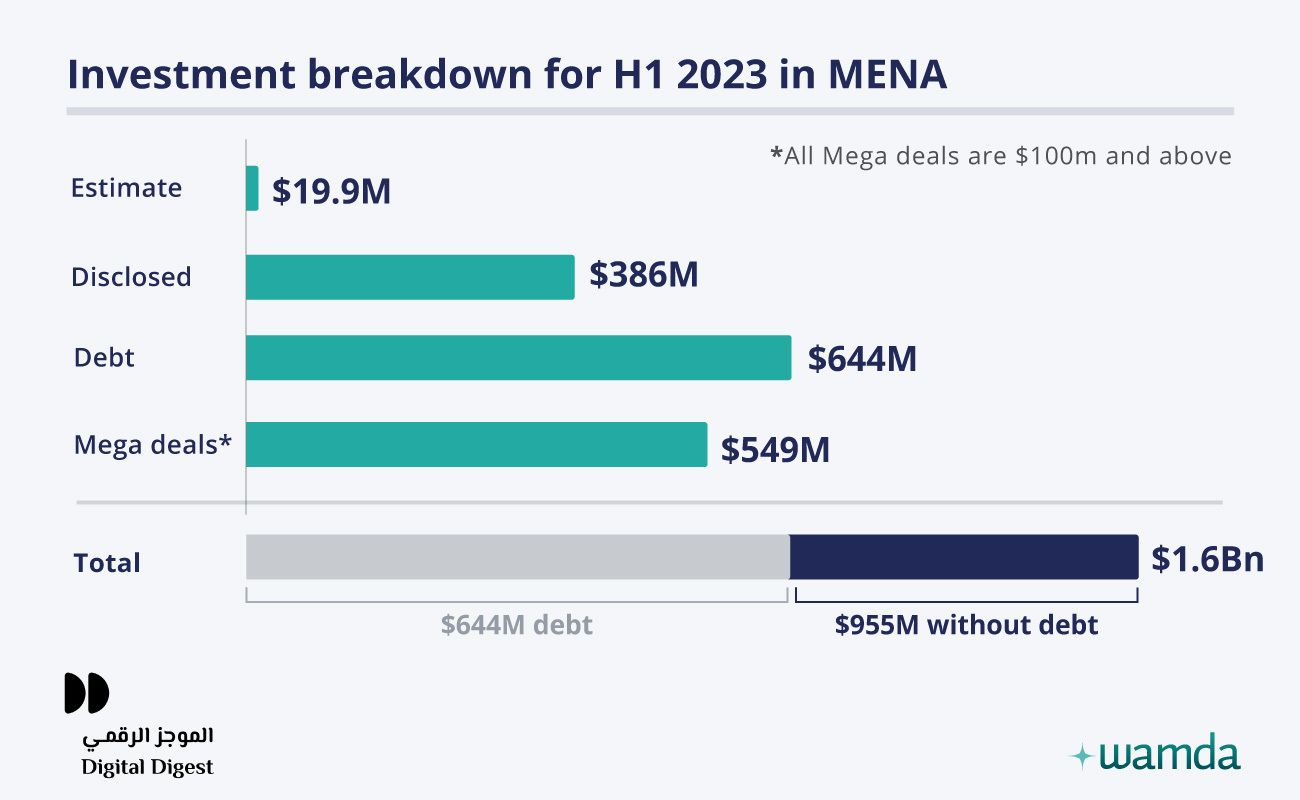

Half year investment (including debt) has dropped by more than 21 per cent from $2 billion in 2022 to a little under $1.6 billion this year.

Without debt, this drop is more substantial at 46 per cent, marking a stark slowdown in equity investing in Mena. While investor hesitancy was noticeable in the first quarter of this year, following the consequences of the war in Ukraine, rise in interest rates and decline of economic growth globally, it is in the second quarter that we see the true impact. Quarter-on-quarter investment was down by 56 per cent and deal count fell by 30 per cent. Q2 investments this year were down by a staggering 83 per cent when compared to the same period in 2022.

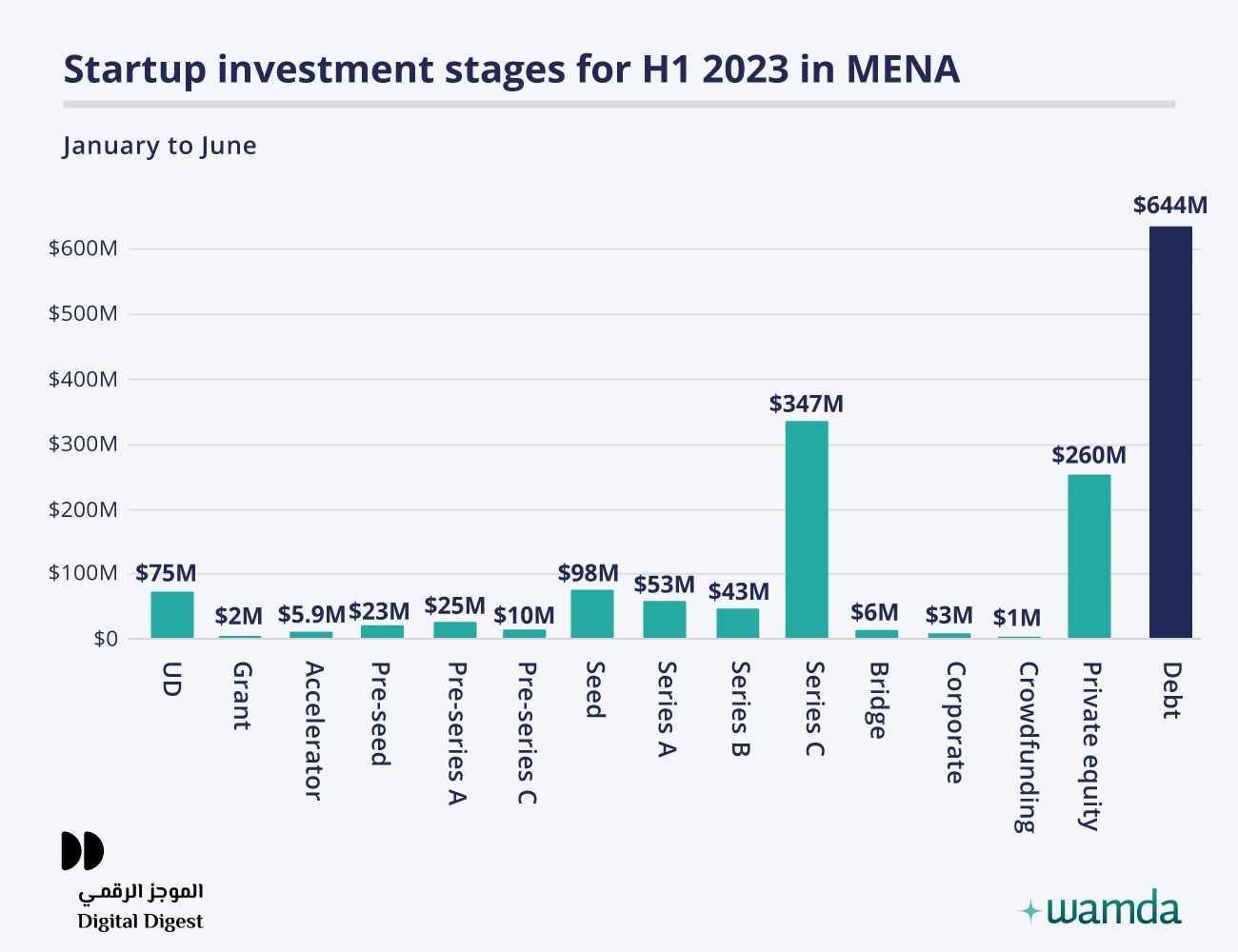

The growing difficulty in raising investment has pushed more startups to consider taking on debt. The region’s debt investment has risen from $250 million in H1 last year, to $644 million in the same period this year. Part of this is down to the continued growth of BNPL with Tamara in Saudi Arabia and Tabby in the UAE taking on large rounds of debt, making fintech the best-funded part of fintech.

Countries hit hardest

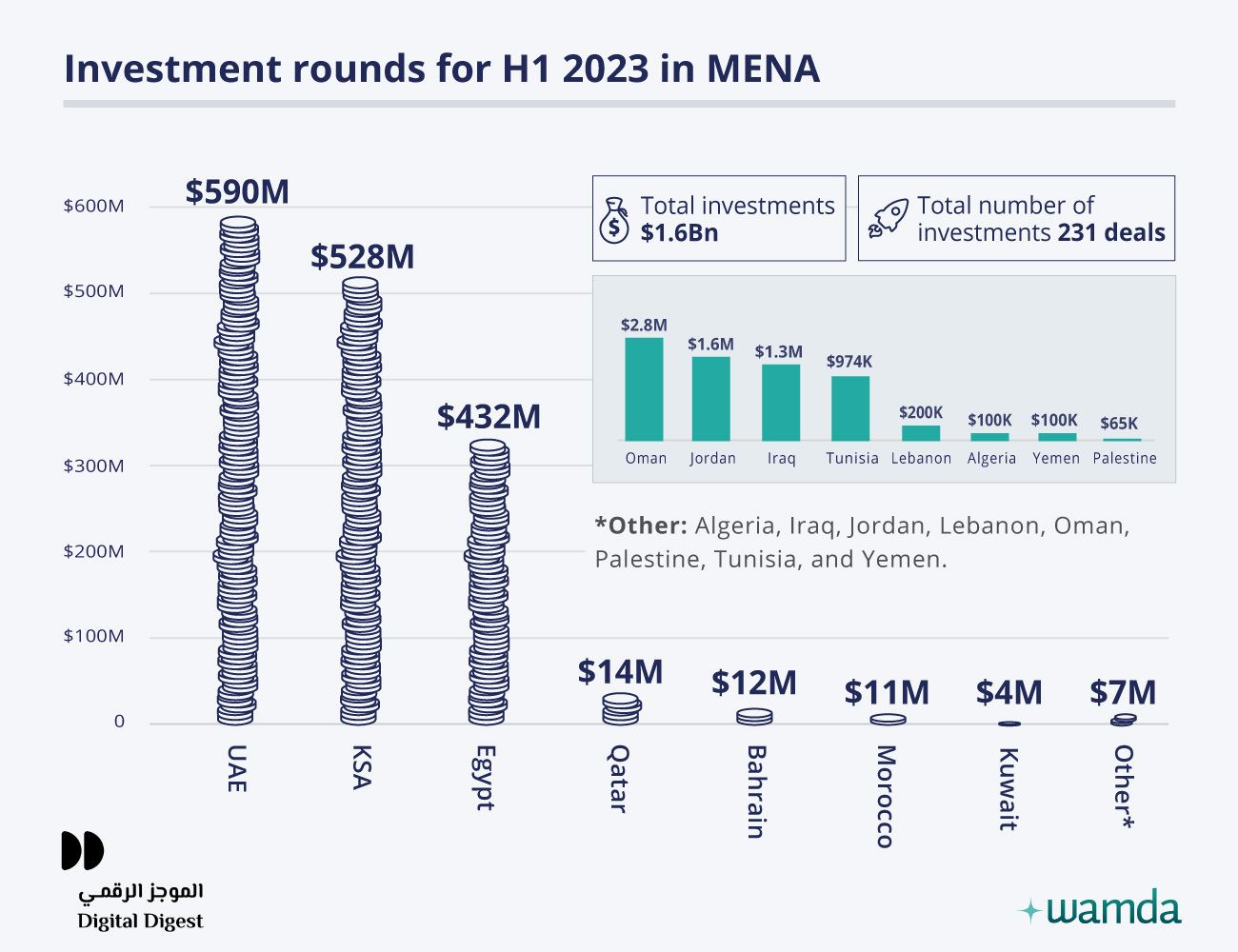

In the first half 2023, the number of deals dropped by over 50 per cent, with the biggest drop seen in Egypt, where there was a 70 per cent decline in the number of deals while the value of investments remained steady with a 9 per cent decline. However, Egypt’s investment landscape has been propped up mainly by one startup - MNT-Halan, which raised $150 million in debt last year and a further $400 million in both securitisation bonds and equity this year. Taking out MNT-Halan’s rounds, Egypt witnessed a 90 per cent decline in funding, from the $324 million it managed to raise in H1 2022, to just $31.8 million in the same period this year. The global economic contraction has hit Egypt hard, crashing its economy into debts that have reached 92 per cent of its gross domestic product (GDP), with the inflation rate standing at 30.7 per cent. Its currency has dropped 40 per cent against the dollar and increasingly, Egyptian-founded startups are seeking better opportunities in Saudi Arabia and elsewhere. In a bid to help improve the climate for startups, the government recently announced a five year tax exemption plan.

In the UAE, deal count dropped by 47 per cent, with funding value falling by 21 per cent. Saudi Arabia’s deal count dropped by 38 per cent but funding value remained steady, dropping by just 8 per cent, down to a rise in pre-Series A funding in the country.

Overall, deal count has dropped across every ecosystem in the region bar Morocco which saw 18 startups raise investment compared to 15 in 2022.

Funding stages

There has been a marked rise in grant funding across the region, particularly in the more nascent ecosystems like Tunisia and Morocco. Series C funding grew from one deal in the first half of last year, to three so far this year namely Tabby’s $58 million round announced earlier in January, Saudi Arabia’s quick commerce startup Nana which raised $133 million from Kingdom Holding and Floward, which was founded in Kuwait but relocated its HQ to Riyadh, raised $156 million. These three deals have managed to push up the proportion of mega rounds, that is ticket sizes in excess of $100 million.

Funding of almost every other stage has fallen this year. The biggest drop however, has been at the pre-Seed and Seed funding stages. In the first six months of last year, 236 startups had raised $366 million at these two stages, compared to just 72 that have managed to raise $122 million between them in 2023.

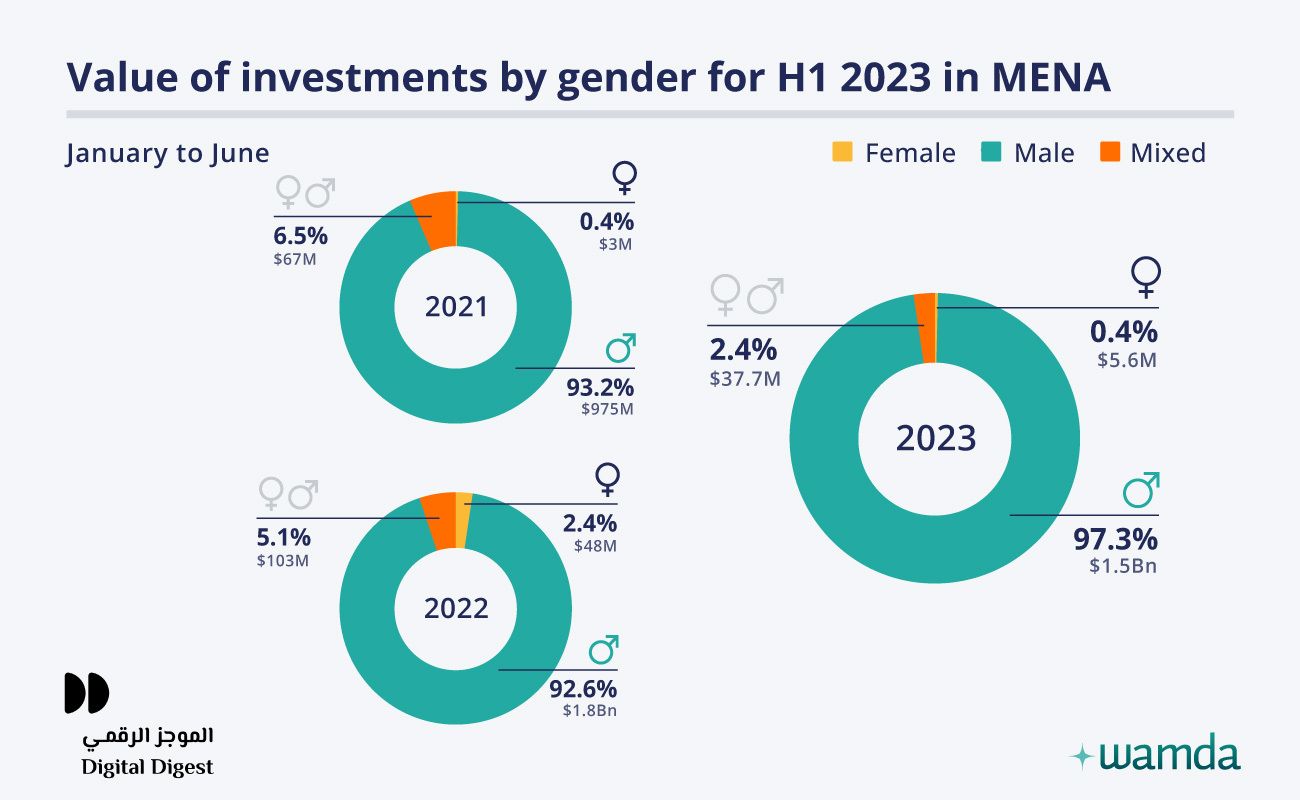

Perhaps most worrying is the drop in funding in female-founded startups in the region. Last year H1, $1.89 billion was invested in male-founded startups, this year this dropped to $1.56 billion. While in the same period, $48 million was invested in female founded startups in 2022 and dropped to $5.6 million this year, an 88 per cent drop.

On a monthly basis, February stood out as the month that saw the highest amount of funding at $759 million across 47 deals (due to MNT-Halan’s $400 million fundraise), while March saw the highest number of deals with 67 due to the graduation of two accelerator programmes.

The most active regional investors in the first half of this year were based in Saudi Arabia, participating in 88 deals, followed by the UAE with 45 and Egypt with 44. Moroccan investors also invested in 11 deals, with Maroc Numeric Fund and Azur Innovation Fund being the most prolific.

Flat6Labs remains the most active investor in the region with 39 deals, while Sanabil 500 in Saudi Arabia participated in 14 deals in the first half of this year.

The US remained the primary source of global investment for Mena startups. US-based investors backed 38 deals in the six months to June. Investors from Singapore invested in five deals, and UK-based investors participated in four deals.

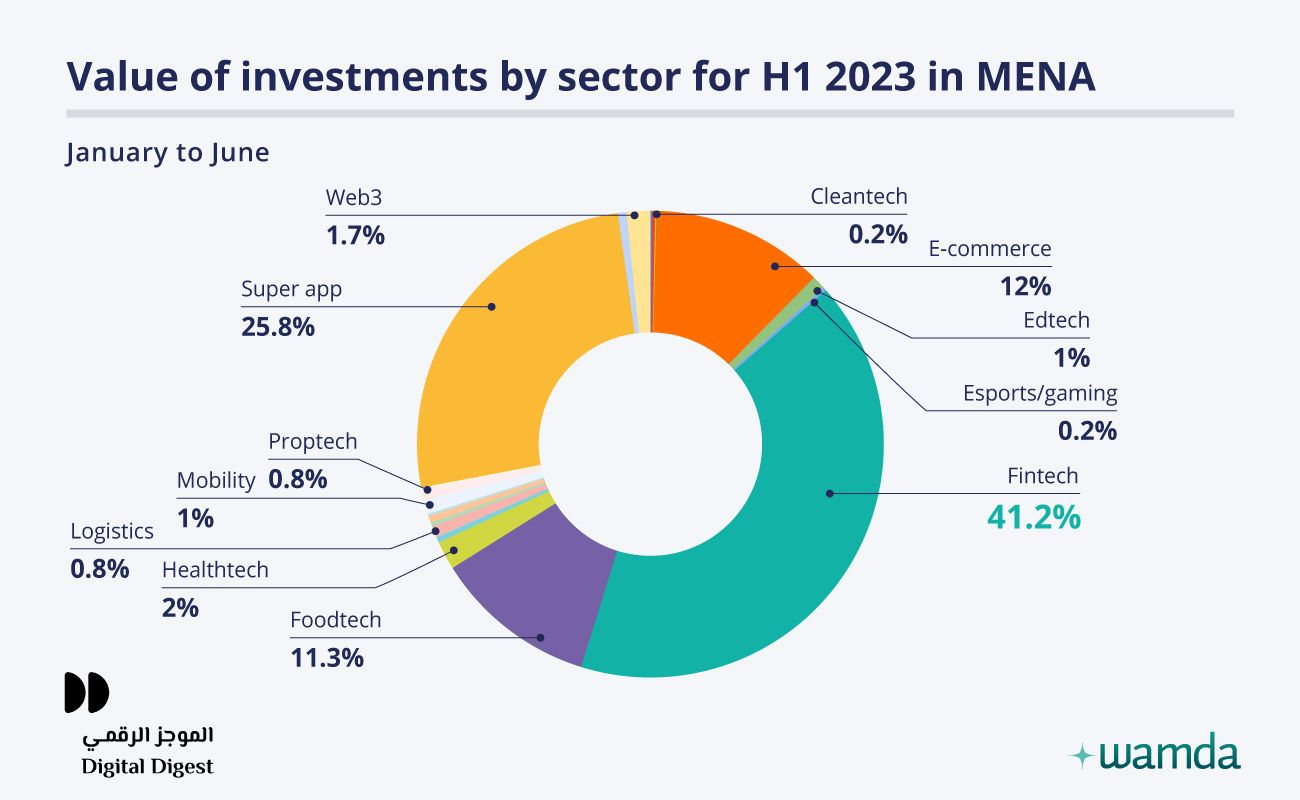

Sectors

On the surface, fintech remains the most active sector attracting almost $660 million in funding across 42 deals. However, more than $560 million of that due to the buy now pay later (BNPL) startups alone. If we take out the six deals in that space, then overall, fintech attracted just over $98 million in the first half of 2023.

MNT-Halan has pushed up investment in the super app sector alongside Qatar’s Snoonu, but it is in the e-commerce and marketplace sectors as well as foodtech where true growth has been realised. More than $198 million was invested in the former, up from $128 million in the same period last year, while in foodtech the jump was more subtle with $172 million in H1Y22 to $181 million this year.

On a broader scale, B2C startups bagged the largest chunk of funding at $1.4 billion, while B2B startups attracted the highest number of deals at 113 worth $165.3 million, a dramatic drop compared to the $979 million raised by B2B startup in H1Y22. This can partially be attributed to the fall in valuations and investor desire to focus on startups with more viable and sustainable routes to profitability.

Exits

The first half of 2023 saw a total of 24 exits in Mena’s startup ecosystem, down from 34 recorded in the same period last year.

A couple of mergers were recorded in the facilities management sector, including Egypt’s Greek Campus’ with MQR and Saudi Arabia’s The Space with Vibes.

Also, three global startups were acquired by Mena-based companies, with the most prominent one being that of a US-based game developer Scopely, acquired by PIF-backed-Savvy Games for $4.9 billion.

This report was compiled from publicly disclosed investment deals. Where the investment amount was not disclosed, we assigned them a conservative estimate.This report was created in collaboration with Digital Digest.