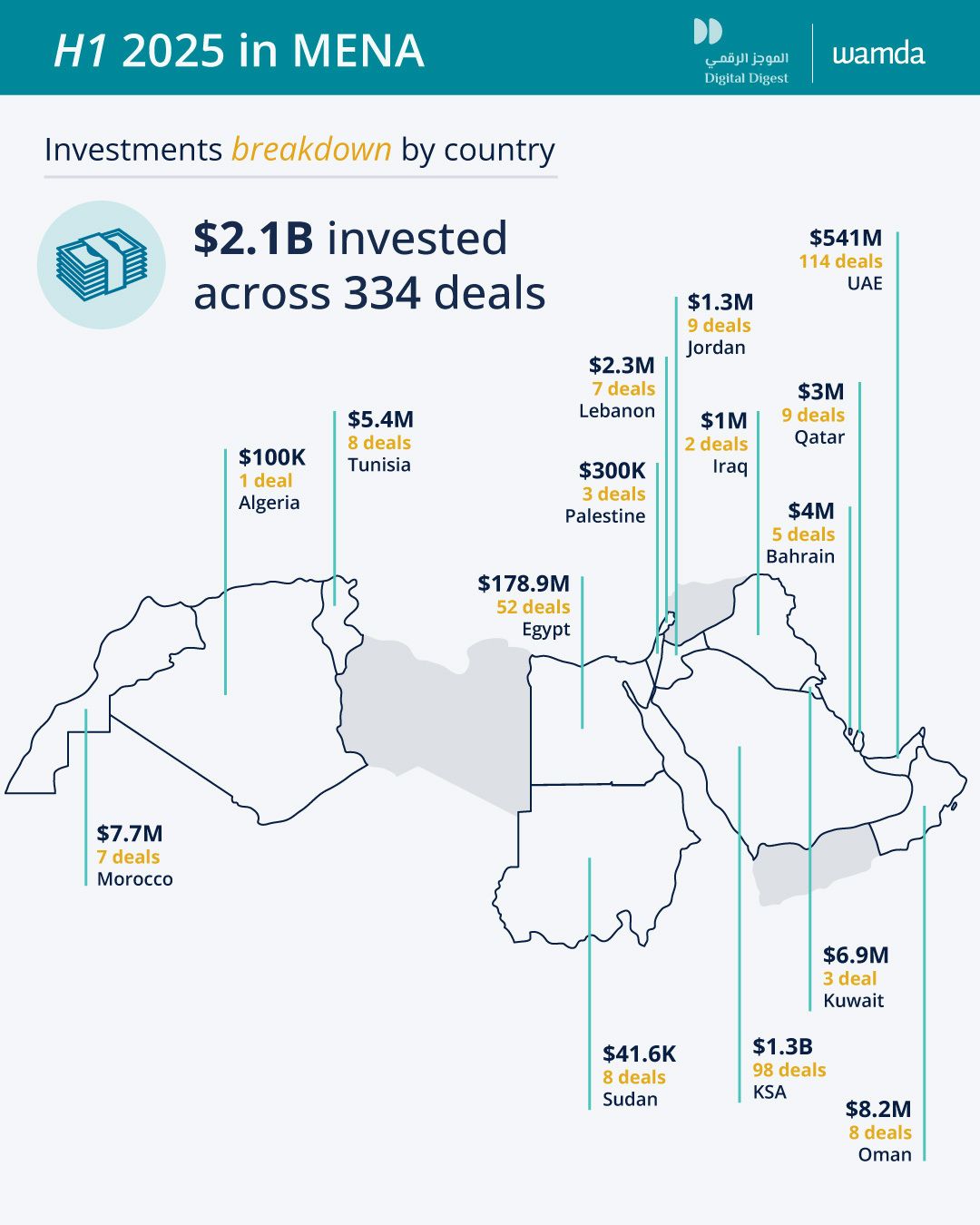

MENA startup investment hits $2.1 billion in H1 2025, up 134% YoY

Startup funding in the Middle East and North Africa reached $2.1 billion during the first half of 2025, with 334 deals recorded across the region — a 134% increase compared to the same period in 2024. While this growth was partially fuelled by an uptick in debt-based financing, the figures nonetheless reflect a notable level of investor activity amid continued regional uncertainty.

Q2 ends on a high note despite June slowdown

The second quarter concluded with $583.4 million deployed across 149 deals, exceeding Q2 2024 in both value and deal count. The performance marks a rebound despite a weaker June, underlining investors’ continued appetite for exposure to the region’s startup ecosystem.

Market conditions remained challenging throughout the first half of the year. Currency volatility, ongoing regional tensions, and fluctuations in global commodities — including gold, oil, and the US dollar — all contributed to a climate of uncertainty. However, select venture capital firms remained active, deploying capital with measured optimism.

Fintech leads Q2; Saudi Arabia regains top funding position

Fintech attracted the highest volume of capital in Q2, with 38 startups securing a combined $170 million. Proptech followed, raising $77 million across eight transactions, while traveltech recorded $40 million through two deals.

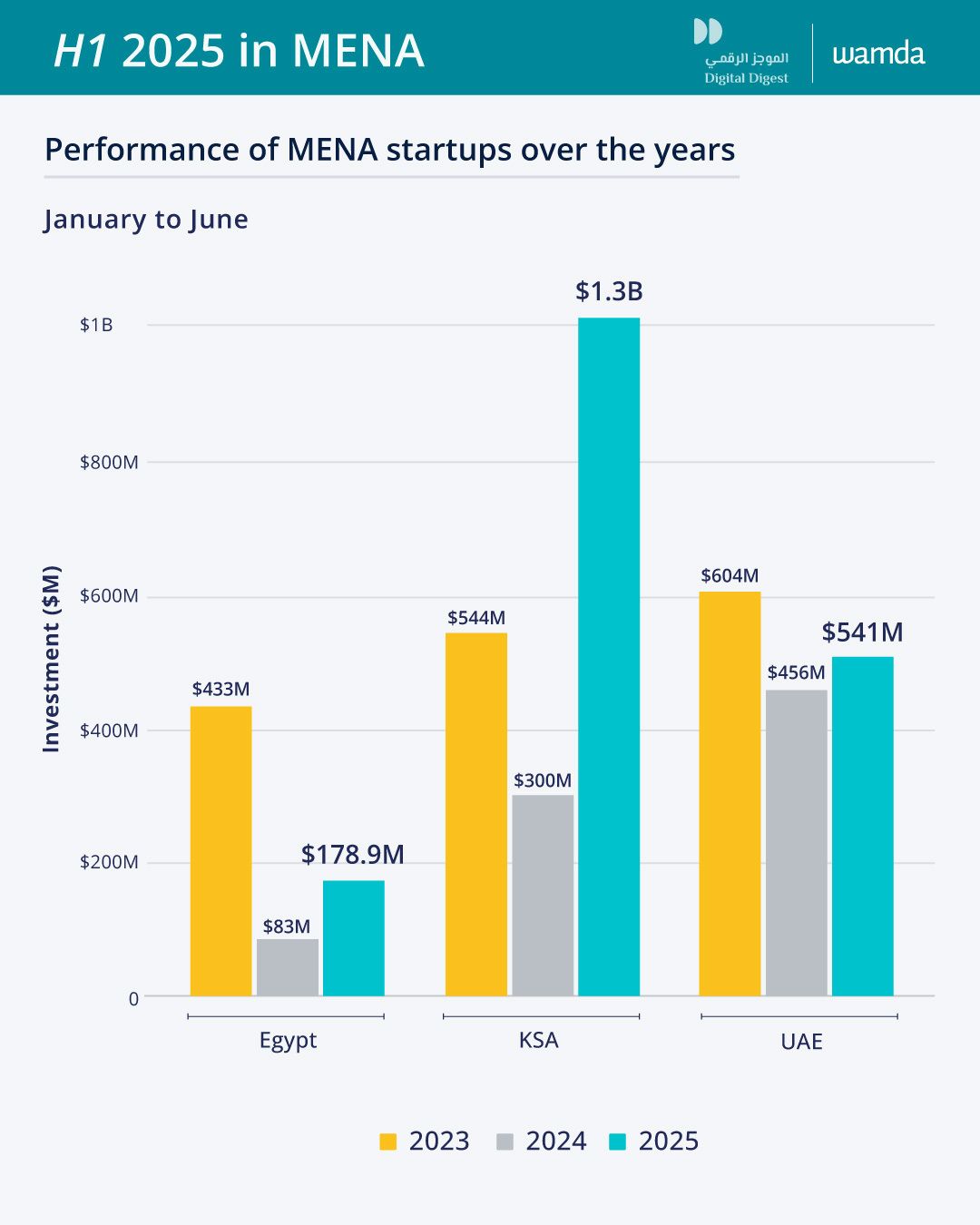

Saudi Arabia emerged as the most funded market in the quarter, displacing the United Arab Emirates. A total of $231.5 million was invested in 38 Saudi startups, compared to $197.7 million across 52 transactions in the UAE. Egypt ranked third, attracting $133 million via 30 deals.

By stage, mid-stage startups captured the largest share of capital, with $161 million allocated across 10 Series A deals. Early-stage startups accounted for the majority of transactions, with 67 deals recorded in the quarter. Only four debt transactions took place during the period, alongside two later-stage equity rounds.

H1 totals show debt financing as a key driver

Total investment in H1 2025 reached $2.1 billion, a significant increase from $898 million in H1 2024. However, when excluding debt-based transactions, which accounted for $930 million, the year-on-year growth narrows to 53%.

This expansion coincided with renewed global attention on the region following the visit of US President Donald Trump, accompanied by a delegation of major Silicon Valley investors. The visit was widely interpreted as a signal of strategic interest in the region’s tech infrastructure and market potential.

Saudi Arabia captures 64% of regional investment

Saudi Arabia accounted for approximately 64% of total capital deployed in MENA during the first half of the year. Investment volumes in the Kingdom surged 342% compared to H1 2024, underpinned by a policy-driven ecosystem and consistent government intervention.

The majority of funding activity in Saudi Arabia was concentrated in fintech, which raised $969 million across 20 transactions. Contech and proptech followed, attracting $48 million and $39 million, respectively. The Saudi market benefited from sovereign wealth funds backing local VC firms, alongside government incentives designed to attract international founders and technologies.

The dominance of male-led ventures remained evident. However, three female-founded startups raised a total of $60 million, and mixed-gender founding teams secured $34 million across seven deals.

Funding activity was largely driven by domestic firms such as STV, Wa’ed Ventures, and Raed Ventures. International participation also surfaced, with JPMorgan backing a debt round raised by Lendo, signalling foreign institutional interest in the Saudi fintech market.

UAE sees steady growth amid competitive pressure

While no longer the region’s top-funded market, the UAE continued to attract substantial investor interest. In H1, 114 UAE-based startups secured $541 million in capital — an 18% increase from the previous year. Debt represented just 19% of total UAE deal volume, reflecting a relatively healthier equity pipeline.

Fintech led the sectoral breakdown with $265.8 million raised across 35 deals. Insurtech followed with $55 million across five deals. Web3 and AI startups each secured $44.7 million in funding — the former through 11 companies and the latter through 13.

Eight female-led startups in the UAE raised $17.6 million, while mixed-gender teams secured $91.7 million. Despite those figures, male-founded startups continued to dominate the capital landscape.

Egypt gains momentum despite macroeconomic strain

Egypt registered a 106% year-on-year increase in funding volume, with $179 million raised across 52 deals. The uptick comes amid ongoing macroeconomic stress, with Egypt’s external debt reaching 38.8% of GDP by the end of 2024. Debt financing accounted for 13% of the funding activity.

Unlike Saudi Arabia and the UAE, Egypt’s most funded sector was proptech, which received $75 million through three transactions. Fintech followed with $85.3 million raised by 10 companies, while e-commerce startups secured $24.8 million across seven deals.

Female-founded ventures in Egypt received $425,000 in total, while mixed-gender teams secured $23 million. The remainder of the funding went to 37 male-led companies.

Fintech, debt, and mid-stage Rounds Shape H1

Fintech maintained its position as the dominant sector across MENA in H1, capturing 62% of all deployed capital through 77 deals. Two of the region’s three mega-deals during the period were directed toward fintech companies.

A single large investment in iMena Group elevated venture studios to second place in sector rankings, followed by proptech, which secured $119 million across 16 startups. E-commerce recorded $65 million in 24 transactions.

Debt-based financing played a central role in shaping the capital landscape. Approximately 44% of H1 funding — or $930 million — was provided through debt instruments, signalling a shift in investor behaviour amid global economic uncertainty.

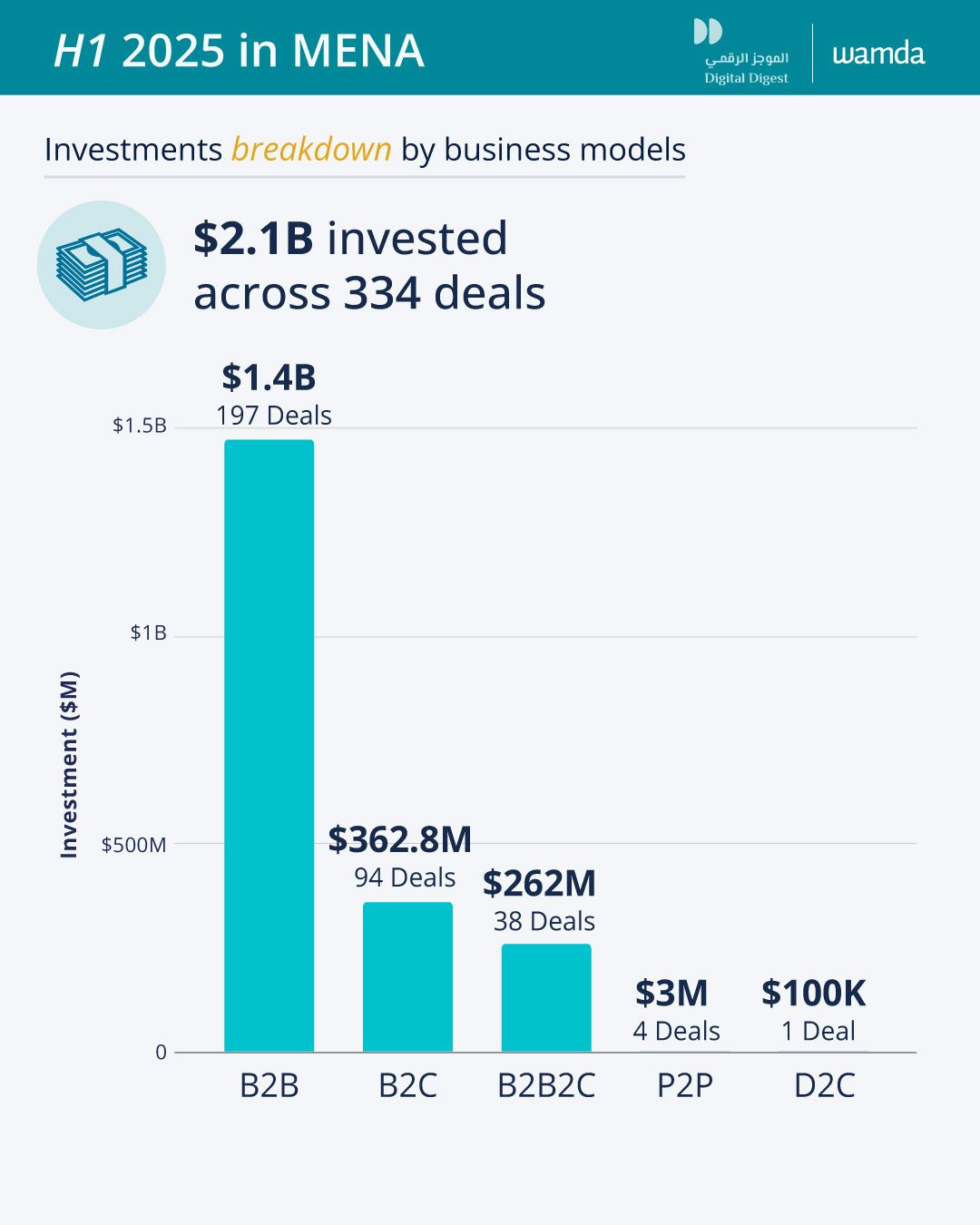

Early-stage activity remains strong; B2B prevail

Early-stage companies (pre-seed to Series A) attracted $568 million in funding, while later-stage companies (pre-Series B to pre-IPO) secured $431.7 million. Despite the dominance of mid-sized rounds in capital volume, early-stage startups continued to lead in deal count.

Business-to-business (B2B) models attracted the majority of investor capital. B2B startups raised $1.5 billion across 197 transactions, representing 70% of total funding in the first half. The remaining capital went to B2C startups or companies operating in hybrid models.

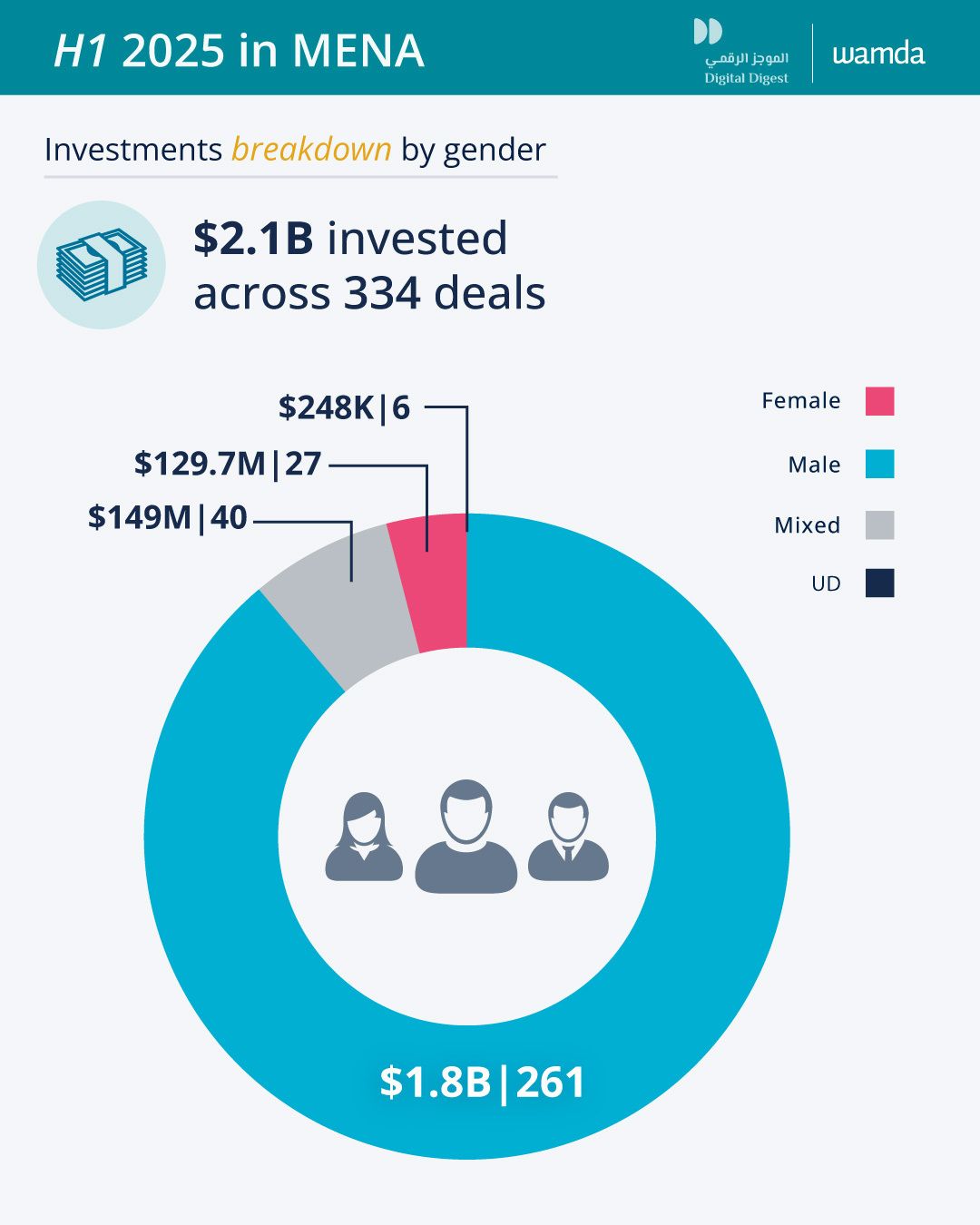

Gender funding gap widens

Funding allocation remained highly imbalanced across genders. Startups founded exclusively by men received nearly 89% of total H1 capital. Female-founded startups accounted for just 27 transactions, raising a combined $84.5 million. Mixed-gender founding teams secured $150 million.

These monthly reports are a collaboration between Wamda and Digital Digest.