MENA startup funding soars to $783 million in July 2025

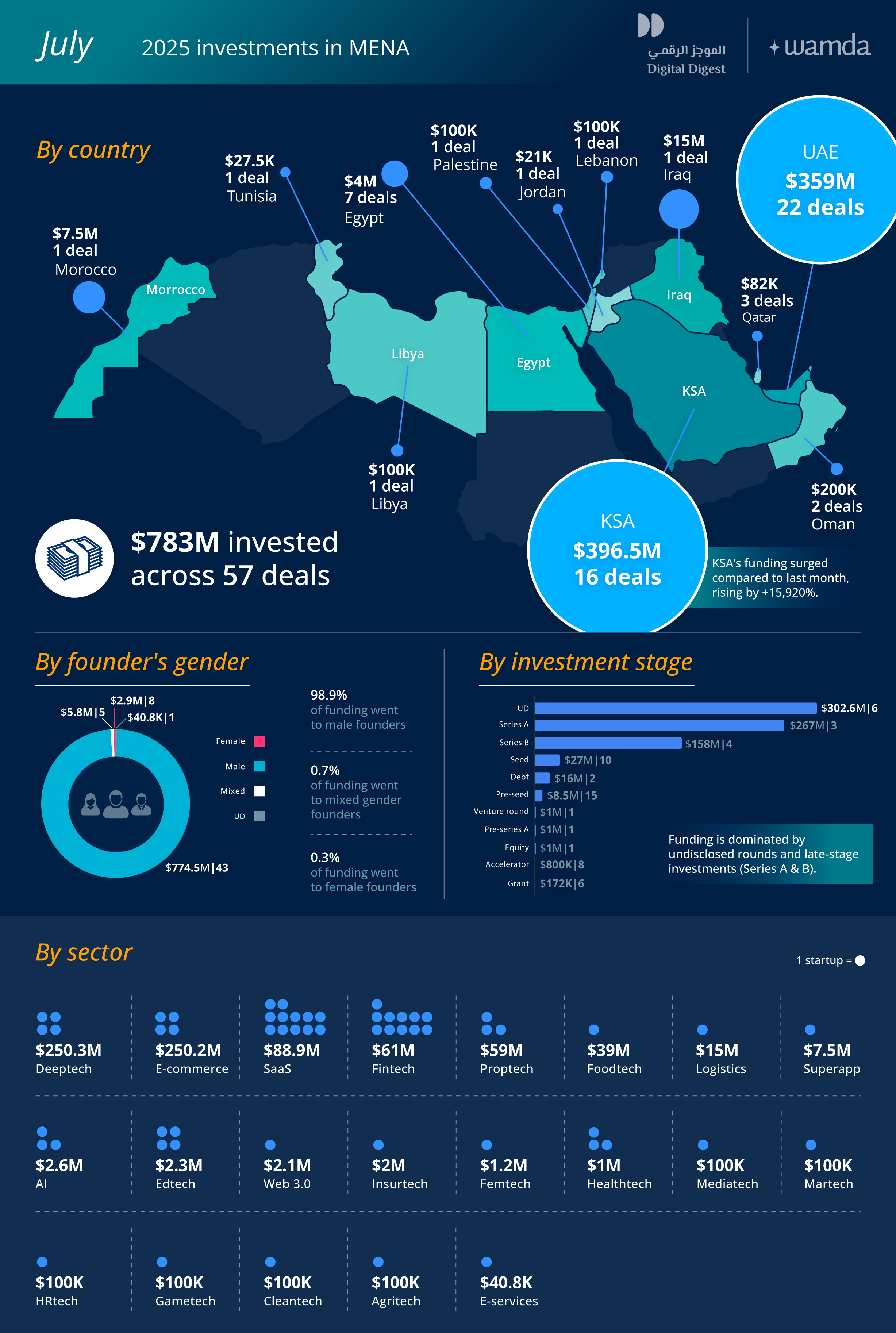

The third quarter of 2025 opened with a strong start as startup investment in the Middle East and North Africa surged in July. Fifty-seven startups raised a total of $783 million, marking a 1,411% jump month-on-month and more than double the total from July last year. The sharp rise was driven largely by two mega deals that dominated the funding landscape.

Saudi Arabia takes the lead

Saudi Arabia retained its position at the top of the regional funding table, with 16 deals worth $396.5 million. The UAE followed closely, attracting $359 million across 22 startups — a reflection of its continued appeal to both regional and global investors.

The month also saw a shake-up further down the rankings. Iraq climbed to third place with a single $15 million deal for InstaBank, displacing Egypt from the top four. Morocco took fourth spot, driven by Ora Technologies’ $7.5 million round. Egypt, once a regular fixture in the top three, slipped to fifth, with just $4 million raised across seven startups — a decline likely influenced by macroeconomic pressures and currency volatility.

Deeptech overtakes fintech

For the first time in months, deeptech led the sector funding, attracting $250.3 million across four deals. E-commerce made a strong comeback, also securing $250 million, thanks to Ninja’s record-breaking raise. SaaS startups ranked third with $89 million across 12 deals, while fintech dropped to fourth, with $61 million invested in 11 transactions.

The shift reflects a growing appetite for IP-heavy, innovation-led ventures and scalable consumer platforms, even as fintech funding cools.

Mega deals set the pace

While many startups did not disclose their funding stages, two mega deals—Ninja and XPANCEO — accounted for 56% of July’s total. Later-stage rounds brought in $158 million, while Series A deals raised a combined $267 million from three startups. An additional 26 early-stage startups secured $36 million. Debt financing remained marginal, making up just 2% of the month’s total, underscoring the dominance of equity-led transactions.

B2C model back in focus

Consumer-facing startups once again took centre stage. Led by XPANCEO and Ninja, B2C companies captured $534 million in funding. B2B models followed, securing $202.4 million across 32 deals, with the remainder flowing to D2C and hybrid-model ventures. The swing towards B2C marks a reversal from earlier in the year, when enterprise solutions dominated investor interest.

Gender gap persists

Funding remained heavily skewed towards male-led ventures. Startups founded by men raised $774.5 million across 43 deals, while mixed-gender founding teams secured $5.8 million. Female-led startups attracted just $3 million across eight deals. Despite growing visibility for women entrepreneurs, the funding gap shows little sign of narrowing.

Opportunities ahead

Seven months into 2025, MENA startup funding has already surpassed the full-year total for 2024 — a clear sign that the region’s innovation landscape is maturing. With Saudi Arabia and the UAE drawing record-breaking rounds, and emerging markets like Iraq and Morocco making surprise appearances in the top rankings, investor interest is diversifying beyond traditional hubs.

The combination of large-scale late-stage bets and a steady flow of early-stage deals suggests that global investors see both immediate scale opportunities and long-term pipeline potential. If this momentum holds, MENA could cement its position as a growth hotspot in sectors where it holds unique advantages – from deeptech and AI to logistics, energy, and cross-border commerce – leveraging its strategic geography, youthful talent pool, and increasingly supportive policy frameworks.

These monthly reports are a collaboration between Wamda and Digital Digest.