MENA startup funding drops to $785 million in October 2025, 72% driven by debt

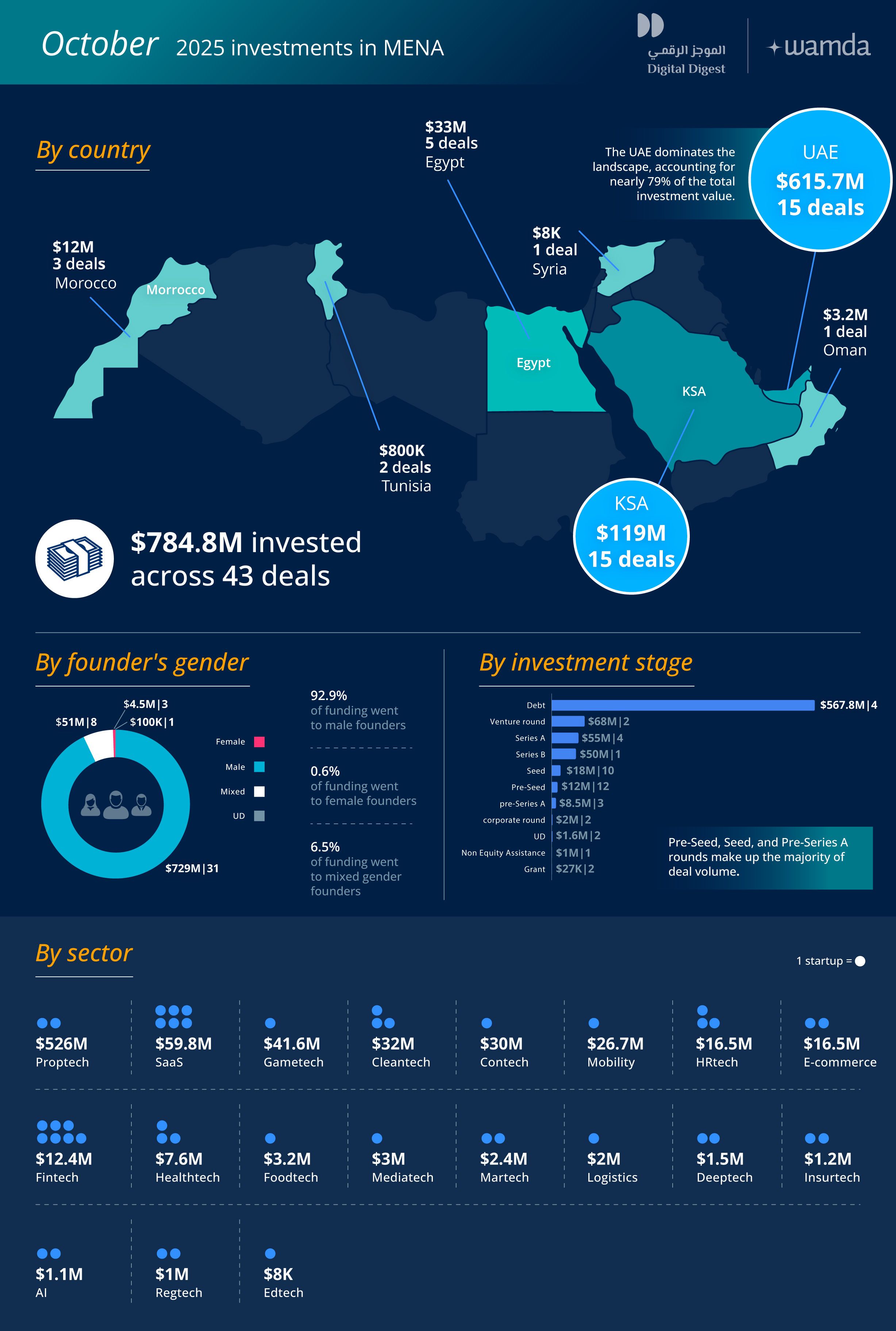

After a record-breaking September, investment activity across MENA startups cooled in October, with total funding dropping to $784.9 million across 43 deals, down 77% month-on-month from September’s $3.5 billion surge. Despite the sharp decline, the figure still marks a 395% year-on-year increase, signalling sustained investor confidence in the region’s tech landscape.

Debt remains the dominant force

Debt financing continued to shape MENA’s investment narrative. Four debt deals alone accounted for 72% of total funding, worth $567.8 million, while equity and other instruments collectively raised $217 million. The data underscores a growing trend of debt-backed growth, particularly among late-stage and asset-heavy startups.

UAE regains the lead, Egypt rebounds

The UAE reclaimed the top spot as the most funded ecosystem in October, attracting $615.7 million across 15 deals, fuelled mainly by Property Finder’s $525 million debt round. Saudi Arabia followed at a distant second, with $119.3 million raised through the same number of transactions—a clear sign that investor attention has rotated back to the Emirates after a Saudi-led Q3.

In a notable comeback, Egyptian startups raised $33.3 million through five deals, outperforming the combined total of Q3, when 22 startups secured just $22.3 million. Morocco held its ground for the second consecutive month, securing $12.3 million from three rounds.

Proptech surges past fintech

After months of fintech dominance, proptech emerged as the top-funded sector, raising $526 million, largely driven by Property Finder’s $525 million debt round. SaaS startups ranked second, collectively raising $60 million, followed by a single $41.6 million gametech deal.

Fintech, surprisingly, fell to ninth place by value with $12.5 million raised across seven rounds, though it remains the most active sector by deal count.

Early-stage startups take the spotlight

Late-stage activity slowed considerably, with only one Series B round ($50 million) recorded in October. Early-stage startups dominated, with 32 deals spanning from grants to Series A rounds, totalling $95.2 million. The data highlights a continued appetite for seed and early investments, where valuations remain attractive and risk-adjusted returns higher.

Shift toward consumer-focused models

The month saw a reversal in business model trends, as B2C startups led by value, raising $594.7 million across nine rounds, compared to $166 million raised by 28 B2B startups. The remaining eight operated hybrid models, blending both consumer and enterprise offerings.

Gender gap widens further

Funding disparities widened once again. Male-led startups captured 93% of total funding, while female-founded startups raised just $4.5 million across three rounds. Startups with mixed-gender founding teams attracted $51 million, reinforcing the persistent imbalance in the region’s capital allocation landscape.

Outlook: a measured cooldown after a record month

Comparing October to September risks misinterpretation— September’s results were inflated by exceptional debt-driven megadeals, particularly from BNPL fintech players. October’s figures instead reflect a more sustainable rhythm of growth. The steady activity across early-stage rounds and the resurgence of Egypt suggest that the MENA startup ecosystem is entering Q4 with healthy momentum, likely to close 2025 as a record year for regional tech investment.

These monthly reports are a collaboration between Wamda and Digital Digest.