The 10 pitch deck slides you need to wow investors

Dr. Mussaad M. Al-Razouki is the chief investment and business development officer of Kuwait Life Sciences Company. He has over 15 years of experience in venture capital and private equity investment with a focus on healthcare and technology

One of my favorite lectures during our Introduction to Entrepreneurship course at Columbia Business School was a session where our professor invited a venture capitalist to come speak about preparing a pitch deck. The venture capitalist started his own pitch by riffing that the best place to start working on a presentation was on a long transcontinental flight; spending the first hour trying to find the right slide template and the next couple of hours playing around with the colors and font. Of course creating a memorable pitch deck is all about creating an aide that will support you (the presenter, the storyteller) in delivering a memorable story about your venture. Remember, you are the main event, not the slides.

In general, less is more, especially when you will likely have a limited time to present a few key slides. So naturally the trick is to keep things as simple as possible, and please stick to Google Slides or MS PowerPoint, never use alternative forms of presenting such as Prezi, it wastes valuable investor time and risks sea sickness.

Content is king, so start with the most important content right at the get-go. Your first slide should be an executive summary that contains both your main ask and all the important high level information you absolutely must convey. Imagine if you only had five minutes or even one minute to pitch, what is/are the key takeaway(s) that absolutely must be delivered to your audience?

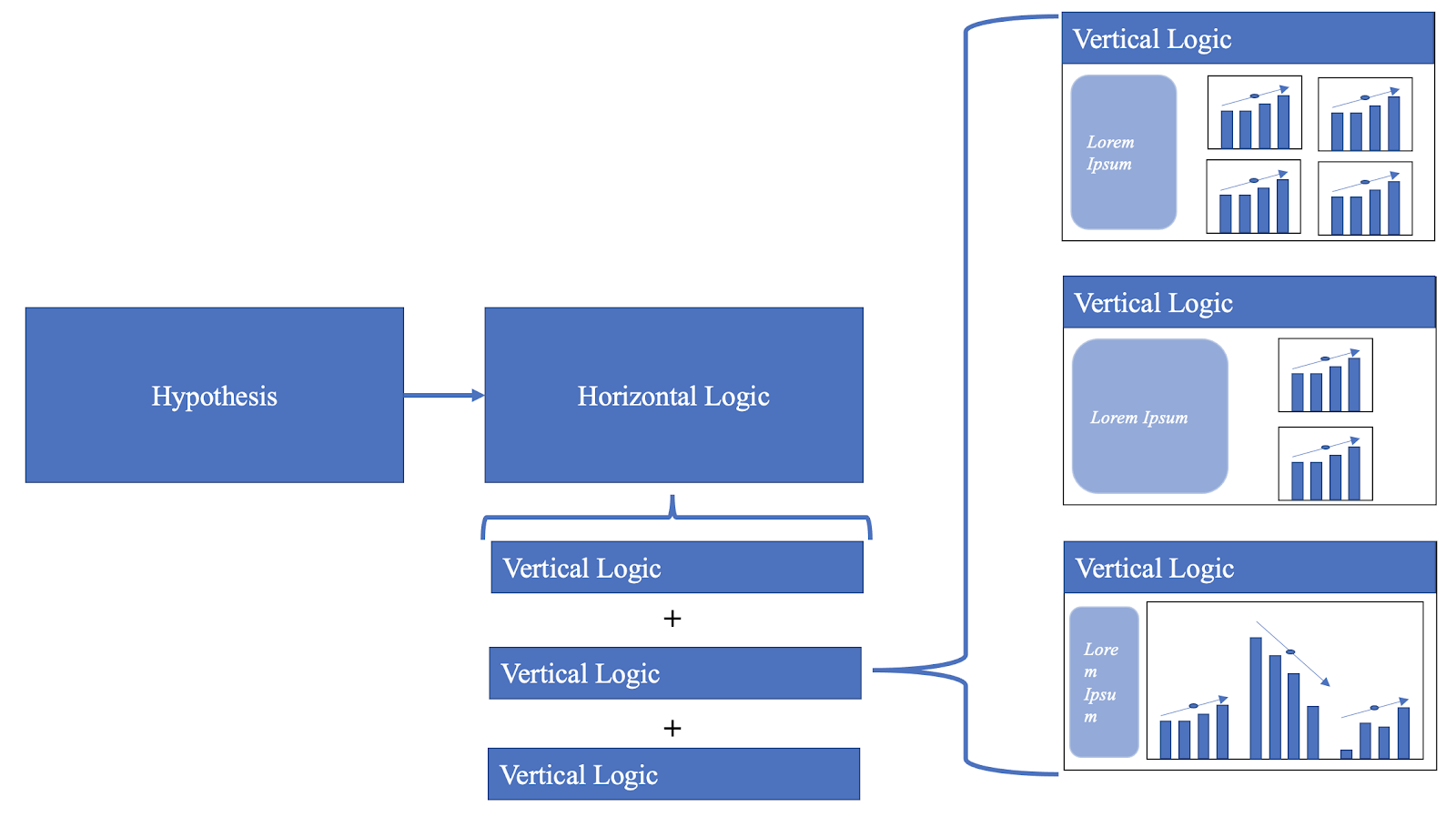

Moreover, an ‘answer first approach’ on every slide is paramount. Start with answering the question or with providing the solution to the problem and then proceed with going into depth with the supporting arguments and data. This concept builds on the ‘hypothesis-driven approach’- a cornerstone of any successful scientific innovation or business process. Stating your hypothesis clearly and then supporting it throughout the presentation with facts and figures is how you make your overall story memorable. Answering first and going into depth later creates the narrative of a story while the hypothesis-driven approach ensures that all the data you present is in line with your initial goal.

Before we get into the key slides that need to be in a pitch deck, it is important to first cover a key technique to ensure consistency and flow in the narrative of your story, by dividing each slide into ‘horizontal and vertical logic’. Horizontal logic refers to the fact that the reader must understand the entire content of your deck (and essentially follow the entire story) by simply reading only the header of each individual slide. Therefore headers from every slide must provide the reader with the full answer to your initial hypothesis.

The vertical logic refers to the main body and content of each slide and corresponds to supporting its respective header or main takeaway statement. Specifically, the header of the slide must sum up the slide in one sentence. Upon reading the header, your audience should immediately see the purpose of the slide while the content of the slide is a detailed explanation of the header.

Consider the image depicted below. Your hypothesis is the general approach, the main gist of your story, the horizontal logic creates your story more in depth, the vertical logic ensures that every sub-header is supported with data supporting your horizontal logic, thus your hypothesis. In short, the data within the slide is the vertical logic. The accumulation of all vertical logic provides the foundation of the horizontal logic which is the answer to the hypothesis.

The 10 key slides: Cover Page, Executive Summary, Hook, the 2Ms, 2Cs, 2Ts and the Summary

Now that you understand how a slideshow should be structured, let us consider each of the 10 must-have slides in depth.

1. The Cover Page Slide: Do not overdo it. All you need is your company logo, the date, your name, title and contact information.

2. The Executive Summary Slide: Includes the main ask and elevator pitch. It should tell a story and quickly summarise the goal of your pitch. As guidance, your executive summary should answer three questions. First, what is the problem you are trying to solve with your product? Second, what has your company achieved to date? Third, what do you need from the person reading your pitch? Do not forget to include vertical logic from this slide onwards.

3. The Hook Slide: This sets the stage for your main story. It is your version of the ‘cold open’ and typically the only slide that does not need to be loaded with too much information. You could opt to use a picture to set the stage or a simple main problem statement or quote. I once had an entrepreneur opt to play a song to set the scene – a gamble that paid off nicely although I usually advise against trying to include multimedia inside your pitch, playing a video is not the most efficient use of the investor’s time, but you could send a video ahead of time. This is also where you ignite the burning platform and how your venture is going to save the world. I usually prefer to keep this separate from the executive summary slide.

Slides four to nine focus on the 2Ms, 2Cs and 2Ts or the Market, Money, Competition, Cost, Traction, and Team respectively, followed by a final summary/next steps slide.

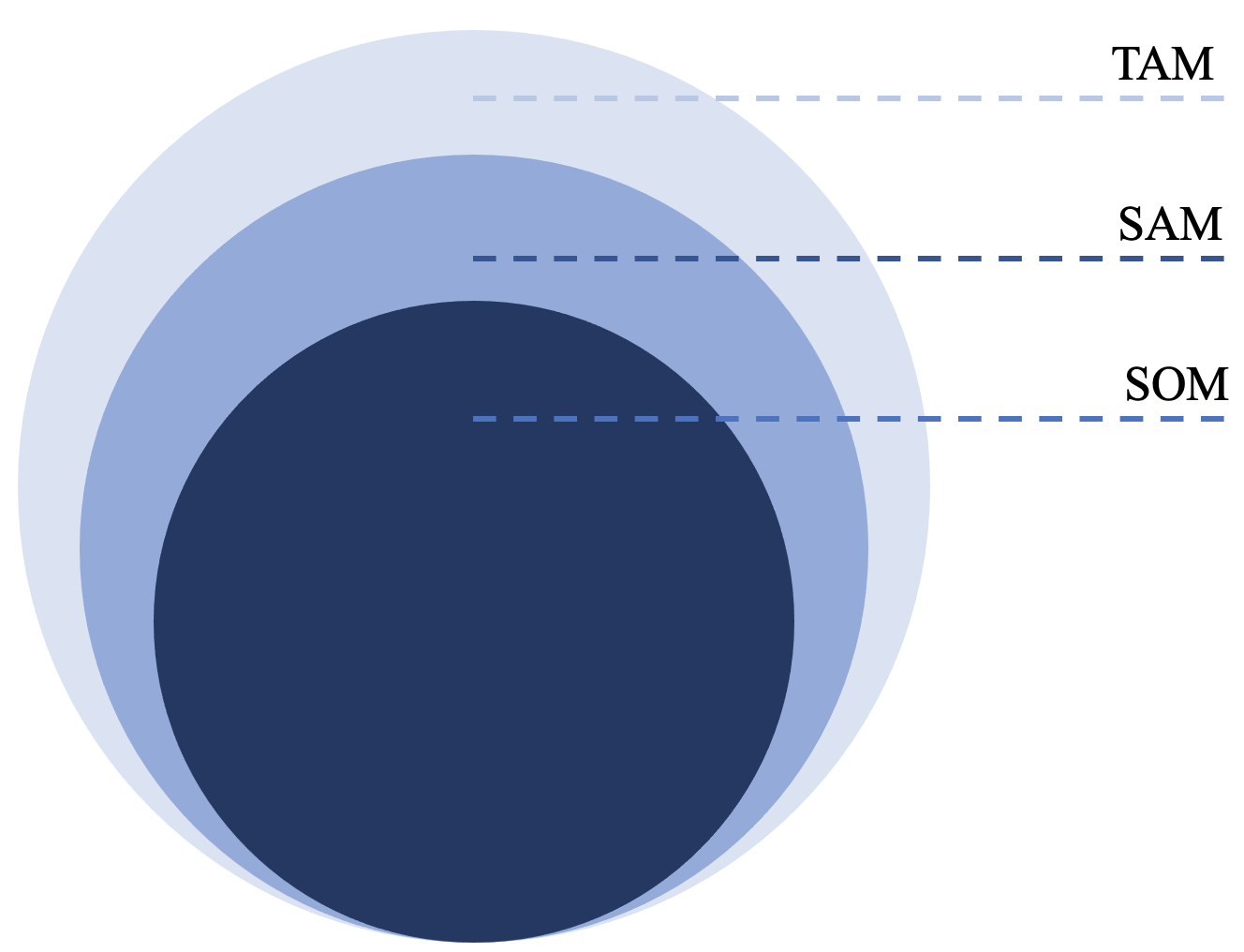

4. The Market Slide: This slide should answer the simple question: Is there a market for your product/service/solution? You must illustrate to the audience the overall market landscape for your product; these include calculating the TAM, SAM, and SOM. TAM refers to the Total Addressable Market, indicating the total (current or future) size of the (global) market you are intent on disrupting. Usually the larger the TAM the higher your venture’s valuation. SAM refers to the Service Addressable Market referring to the market that can be serviced by your innovation in the short to medium term or within your designated geographic or consumer scope, especially once your venture is firmly on the path towards growth. SOM refers to the Service Obtainable Market indicating the lowest hanging fruit in terms of rapid adoption, either in terms of timeline or geography or industry/subsector.

5. The Money Slide: Specifically, it should illustrate how your startup intends to, or is making money. Each and every revenue model must be outlined in detail to demonstrate that the underlying unit economics of your business will eventually lead you to the path of profitability. Sometimes, it is also important to include failed business models in this slide.

6. The Competition Slide: This slide should cover all existing competition (even if it is traditional vs technical). This slide should either be structured as a chart or a simple list that compares your startup's Unique Selling Proposition (USP) in other words, how your own venture is unique compared to the incumbents in terms of key services or trends.

7. The Costs Slide: Founders must have calculated the current and future (post funding) monthly burn rate, broken down to the individual employ/module level. An 18-to-24-month runway is usually advisable. Nevertheless, this can also be discussed in more detail with your investors, especially if you are seeking the best kind of investors; the ‘smart’ money that has experience in your chosen industry.

8. The Traction Slide: It is important to highlight what you have achieved so far as a venture, usually here we mean the metrics beyond the simple financial bean counting. For example, if you are pitching a software company, you will want to include your platform’s current Daily Active Users (DAU) or Monthly Active Users (MAU). Additionally, as a SaaS company, you may want to add your ‘Rule of 40’ index, which shows that your growth rate plus profit margin is higher than 40 per cent. Another important venture financing metric is the customer lifetime value/your customer acquisition value (LTC/CAC >3 ratio). This ratio will show you how much profit a customer brings to your company and how much this customer is costing you as a company, which should be above three, usually.

9. The Team Slide: Remember, smart money venture capitalists are not investing in robots, but rather a high functioning team of human beings with a shared goal and common drive. Traction values are important and will tell you a lot, but highlighting your team, your prior experiences, your values and beliefs are what will make a perfect ending to your pitch, especially the earlier you are in building your venture.

10. The Summary/Next Steps Slide: Again, keep this one simple. It is usually recommended to place at the end with a call to action or prompt a wider discussion about how your investor can add real value to your startup journey. Remember to thank your audience for their attention.

Finally, beyond the ten key slides, you should always include an appendix consisting of your income statement, your balance sheet, your statement of cash flow and any other slides that did not make it into the main deck. Additionally, you could include a product pipeline slide, or a slide that depicts all your current and future clients, which sectors they are working in, and how much revenue you are generating per client. You should also be prepared to demo your solution during the pitch, but I would recommend holding off until after you have had the chance to set the context with your own story and presentation. If your solution is an actual physical product, then you may decide to pass it around prior to the presentation, but my personal preference would be to reveal it at the end of the presentation.

Slide design and presentation style

A quick comment on slide design and presentation style. In terms of the colour scheme, avoid being too colourful. Your pitch deck should be visually appealing, so do not go above and beyond with changing the shade of blue for every graph, rather stay cognisant of the story you want to tell. For example, if you want to highlight the growth of a specific country across two graphs, consider changing the shade of the bar of this country in both graphs to make it easily visible to the reader. Remember that form follows function, hence every colour shading, every word, line or graph needs to have a specific reason and purpose for being where it is.

We must remember that every square millimeter of every single slide is highly valuable real estate. Do not create slides that are overly simplistic or too difficult to read at first glance. The devil is in the balance. It is usually best to assume that no one has read anything before your pitch and to explain your venture and your ambitions “as if you were explaining it to a four-year-old” without any obvious condescension. Thus, you will want to be concise, but at the same time do not shy away from creating dense slides, so long as there is a method behind the density.

Finally, in terms of slide structuring, it is typically expected that you either cut your slide in one, two, or four areas. This means that you can either choose to display one large chart, two charts and text, or four charts and text. Avoid creating too many text boxes as you want to have one to three key messages per slide. The structure of your slide should be simple to allow the reader to focus on its content. Now, even though the aforementioned 10 slides are the only ones you really need, it is OK if you feel you need two slides to explain your revenue model or two slides for your team e.g. one for the management team and one for your advisory team. Do remember though, that less is more. Always.

When it comes to your general presentation style; confidence is key. It is important to be yourself, but to be the most professional version of yourself. Never ever simply read the content of the slides. Remember that the slides are only there to support you as the storyteller.

It is extremely important to practice in front of an audience or a group of colleagues or friends who can best mimic the actual audience you plan on presenting to. In these practice sessions, it is important for the mock presentation to be more difficult than the final presentation. So definitely encourage your colleagues or friends to be as aggressive as possible during the trial runs. As the saying goes, the more you sweat in training, the less you will bleed in battle.