Startups in Mena raised $439 million in November 2022

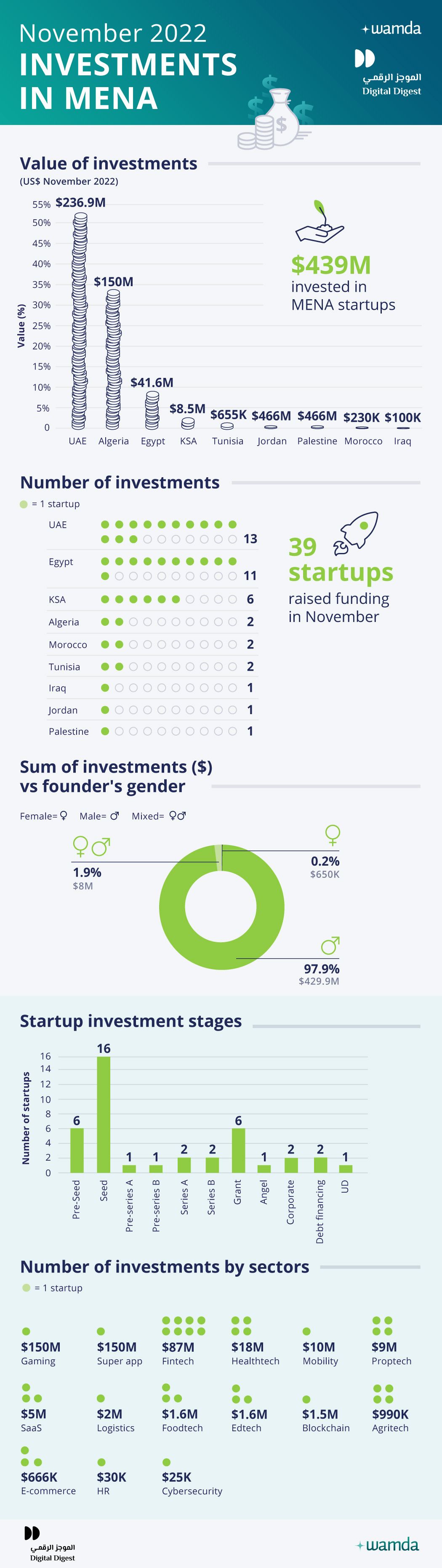

Startups in the Middle East and North Africa region (Mena), raised $439 million in November 2022 across 39 deals. On a month-on-month basis, the value of funding fell 32 per cent, while the deal count saw a 43 per cent decline. Yet, the total funding value was up 55 per cent from the $284 million raised by startups in the same period last year.

With $237 million raised across 13 deals, the UAE maintained its top spot in terms of the number of deals and their value. It was followed by Algeria thanks to super app Yassir's $150 million Series B round.

Coming in third was Egypt whose startups collectively raised $42 million across 11 deals, with buy now pay later (BNPL) platform Blink scooping up the biggest chunk at $32 million in a debt financing round, while Saudi Arabia emerged fourth, having secured $8.5 million across six deals.

A substantial amount of funding was also allocated to startups from Tunisia, Morocco, Palestine, Iraq and Jordan.

The spike in November funding was attributed to the two $150 million rounds raised by Yassir and UAE-based gaming platform Fenix Games. Both rounds account for 72 per cent of overall funding value.

With the share of late-stage activity showing a dramatic fall, early stage companies witnessed the highest uptick in terms of deal count. Of $439 million raised last month, $45.7 million went to Seed and pre-Seed startups, which dominated the funding landscape in terms of deal count with 22 deals, a sign that investors are more than ever skewed towards backing early-stage rounds where the cheque sizes are smaller.

Within sectors, the two mega rounds raised by Yassir and Fenix helped their respective sectors move up to occupy the top spot. Fintech slid to the second position with $87.7 million, a figure that is roughly on par with the total amount allocated to fintechs in the same month last year.

Healthtech also gained significant traction last month, with startups bringing in $18.6 million. Top fundraisers were the UAE's Okadoc and Egypt-based B2B pharmaceutical marketplace Grinta, both raised $10 million and $8 million respectively. All in all, B2B startups collectively raised $215 million, meanwhile B2C startups grabbed $202 million.

As ever, male-owned startups dominated with $410 million spread over 35 deals, while startups with mixed-gender founding teams raised two per cent or $8.5 million. Female-founded startups only raised a couple of rounds totaling $750,000, translating to less than one per cent of funding activity.

The US remained the prime source of foreign investment flowing into startups in the region. Out of 39 deals, 16 attracted direct investment from global investors, with US-headquartered investors participating in eight. Regionally, Saudi Arabia-domiciled investors were the most active, investing in 10 deals followed by their counterparts from the UAE with eight deals.

November also witnessed a couple of acquisitions, with Floward acquiring perfumery brand Mubkhar and foodtech company Jahez acquiring The Chefz, a dessert delivery startup in a deal valued at $173 million.

In November, a couple of startups did not disclose the exact amount they raised. They include live commerce startup Hoods and e-commerce platform Orderii. We have assigned them a conservative amount of $100,000 each.

These monthly reports are a collaboration between Wamda and Digital Digest.