Mena startups raised $7 million in April 2023

Ramadan is usually a slow month for news and announcements, so it was no surprise that investment announcements would drop in April. What was surprising however, was by how much.

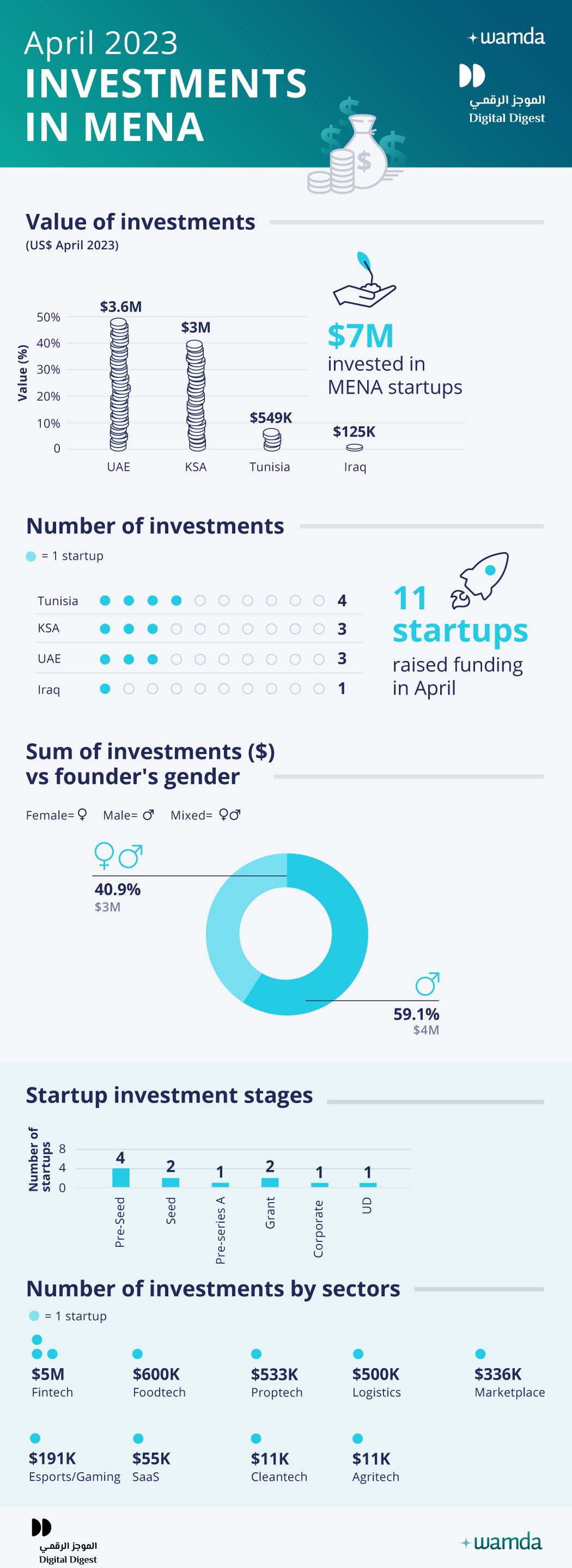

In April 2023, startups based in the Middle East and North Africa recorded a little over $7 million, a drop of 97 per cent compared to March 2023 and a 99 per cent drop compared to April 2022.

This dramatic slowdown was compounded by the Eid and Easter breaks and the subsequent fallout from the Silicon Valley Bank crisis. It also highlights the decline in tech startup investment globally, following the outbreak of the war in Ukraine.

In March 2023, more than $247 million was raised across Mena. While $150 million was down to Tamara’s debt financing round, taking this one deal out still results in $90 million invested more in Mena startups compared to last month.

April’s $7 million, raised across 11 deals takes us back to 2018/2019 levels, when investments in startups was much slower than it has been for the past couple of years. Of the amount raised last month, a little over $3 million went to three startups in the UAE while another $3 million was invested in three startups in Saudi Arabia.

The dearth of (publicly announced) investment will continue, but perhaps not at the same pace as last month. Already in May, two deals have been announced, worth a combined $35 million. April will likely stand out as an anomaly this year, but that does not mean investment in startups will boom. In fact we are likely to see decreased valuations, down rounds and distressed sales.

We will hear of more exits this year, from startups flush with cash looking to expand their foothold in the region, to fatigued founders looking for a way out.

Last year, it was Careem that became one of the more active acquirers in the region, but this year, it itself became the target of an acquisition. Etisalat’s VC arm, e& Capital, invested $400 million for a majority stake in Careem’s super app. Careem’s ride-hailing business will remain fully owned by Uber (which acquired Careem in 2019 for $3.1 billion) but will continue to be available with all other services on the existing app for customers.

Careem launched its super app with a $50 million investment back in June 2020, adding a roster of different products and services onto its platform. The company took inspiration from the likes of Chinese tech giants – WeChat and Alipay, and Indonesia’s Gojek, platforms on which its users communicate, consume content, order their groceries and dinners as well as apply for mortgages and transfer money to peers. Super apps are a way of providing an ecosystem within the internet that offers a variety of services that work seamlessly together to offer convenience to its users with a single log-in and profile. The strategy has worked well for Careem so far with users of multiple services of the app conducting three times more transactions per month compared to single service users.

Meanwhile e& has been developing its loyalty programme, Smiles, into an “everything” platform. It began by acquiring grocery delivery startup El Grocer in 2021 and has since invested in or acquired several other startups in the region in media, home services and fintech. How it combines Smiles with Careem’s super app remains to be seen.

We decided to omit the $50 million raised in April by metaverse company Everdome. While its headquarters are in the UAE, its team sits in Poland while its CEO is in Prague.

These monthly funding reports are a collaboration between Wamda and Digital Digest