Where does the next level of innovation lie in Mena’s insurtech sector? [part two]

![Where does the next level of innovation lie in Mena’s insurtech sector? [part two]](https://cdn.wamda.com/feature-images/5d7ab6a0fad9a20.jpg)

This is the second in a two-part series on the insurtech space in the Middle East and North Africa (Mena). The first part can be found here.

Broadly speaking, the insurance industry in Mena is primarily led by commercial insurance, while retail insurance, also known as personal insurance, accounts for only a small chunk of written premiums.

The result of this is that the region is a laggard in terms of penetration rates of insurance products relative to global markets. It is estimated that insurance penetration, measured as the ratio of insurance premiums to gross domestic product (GDP), drives no less than 2–3 per cent of the region’s GDP, lower than the global average of around seven per cent. One exception to that is Morocco, where penetration rates amount to 5 per cent.

“The sector doesn't get or generate as much user interest, or consumer interest as banking or payments. That's a perennial issue that insurance has always struggled with,” says Zohair Ali, former director of key accounts and operations at MIC Global, a micro insurance provider.

“There's no voluntary sense of urgency to purchase insurance to cover other risks. That's something perhaps that needs examination by the insurance industry itself—that the industry cannot be completely driven or is completely dependent on regulatorily imposed insurance for certain specific risk cases,” he adds.

Despite being the region’s most populated country, Egypt has one of the lowest penetration rates at 0.75 per cent. Part of the reason behind the low accessibility of insurance products in Egypt is that for the most part, insurance is not compulsory. In terms of value, the insurance market is estimated to be worth around $3 billion, with a growth rate of 18.5 per cent recorded over the 2021/22 fiscal year. That growth is primarily driven by the commercial and banking sectors.

In an effort to boost penetration rates, Egypt’s government recently approved a new unified insurance law whereby more professions and population segments will be qualified for coverage. Personal insurance in the country is likely to take off as well, with the key driver of change being the rising cost of living and the willingness of customers to seek ways to protect themselves from unforeseen financial woes.

An overall unfriendly consumer experience in the insurance industry has contributed to the underwhelming performance of the insurance space.

“The market [penetration] is less than one per cent for insurance companies. And most people afford to pay premiums but don’t rely on insurance, so 60–70 per cent of medical expenses are paid out-of-pocket. There's an age-old disconnect between the insurance industry and consumers. And if that amount of money is collected by insurers, the market would easily be worth twice its value,” Darwish adds.

The lack of consumer trust can also be attributed to the inefficiency of disruption methods adopted by insurance incumbents.

Distribution

Across Mena, insurance companies rely mostly on distributors or network agents to reach out to wider segments of society to sell insurance products. These agents lay a greater focus on serving the corporate segment to realise better profit margins.

“To optimise effort and time, agents mostly seek out big-ticket insurance to make profits. So there’s a product irrelevancy problem in the market. The increased reliance on non-direct disruption has allowed for a lot of misleading or fraudulent practices, widely known as mis-selling,” says Shady Eltohfa, co-founder of Amenli.

The fragmentation of distribution channels in insurance has created an opportunity for startups to make inroads into the space. Recently, a spurt of startups emerged to facilitate a better distribution process for insurance incumbents through a marketplace where insurance products are sold to the customers, all while making the entire process easier to navigate for the end users as well.

“The opportunity is big for us [as aggregators] in retail insurance, since we solve the challenge of matching the right customers with the right product. Using technology helps increase transparency and personalisation of products as well. So basically, we, as aggregators, our role is to provide tools to enable existing players to be efficient, not replace them,” Eltohfa adds.

Aggregation is the most prevalent model in Mena’s insurtech space, and the reasons for that are manifold. For one, it is an effective way to increase the insurer's ability to maximise its distribution footprint. And from a startup perspective, it is a model that has already been adopted globally, so its nuances are well understood by founders and VCs as well.

Aggregation is also the only insurtech model that has been acknowledged by regulators across the region.

In Saudi Arabia, the aggregators’ market share is worth SAR 7.7 billion, according to Abdullah Alzakry, founder of Eltizam. "Insurtech does not have a specific model. It is a wide ocean, and aggregation is part of it, yet it is a fast-growing segment. It exhibited 38 per cent growth in 2022 from the year prior," he says.

Amenli and Eltizam are among a growing list of startups operating as aggregators across Mena.

Another distribution-specific challenge facing insurers is changing customer expectations, as more users are increasingly looking for personalised, convenient, and digital experiences. From there, most aggregators incorporate embedded insurance products into their platforms. Moreover, as a means to lure customers, startups of different industries are also offering embedded insurance as part of their solution.

“It is important to develop distribution in one of two ways: either by providing the tools and the digital capacity to agents so that they can complete a transaction very quickly and very efficiently, or by embedding insurance into a platform that's already trusted. So, the B2B2C model is most effective in this part of the world,” says Cillin Flynn, general partner at London-based Noria Capital, an insurtech-focused VC firm with offices in Saudi Arabia and the UAE.

But to pull that off, building and maintaining customer trust in the insurance experience adds to a long list of challenges that insurtechs and startups have to weather.

“Insurance isn't tangible. When someone buys something that they don't actually receive, building trust with them online is quite difficult. And the fact that it's online means it's less personal,” he adds.

Due to the nascency of the insurtech sector, the distribution side of the business has the highest levels of entrepreneurial activity, while the technical part, which involves underwriting and managing risks, remains largely untouched due to the prevailing lack of core competencies and digital skills in the insurance space.

“One of the obstacles in the Mena region is that there aren't enough insurance skills. So the insurtechs are technology people solving a problem rather than technology and insurance people solving a problem,” Flynn adds.

Funding

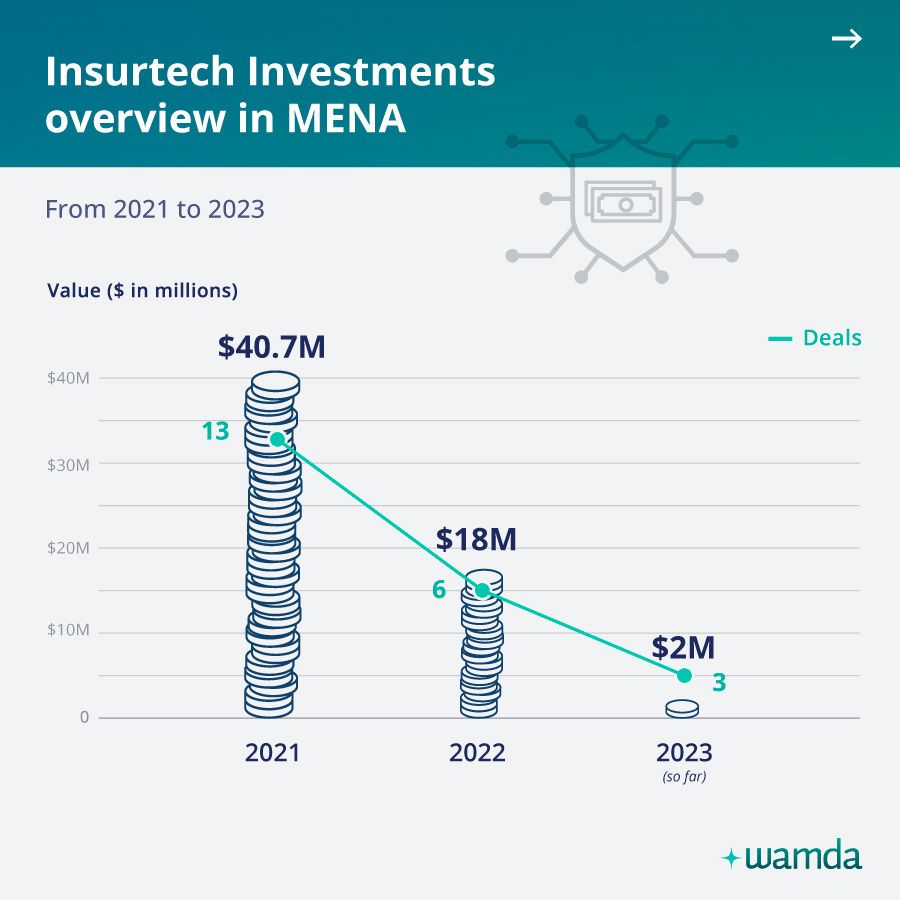

Last year, six startups in the insurtech space raised investment amounting to $18.3 million, a drop of more than 55 per cent year over year from $40.56 million raised in 2021 over 11 deals. Saudi Arabia-based Rasan and UAE's Bayzat bagged the largest rounds so far, having raised $24 million and $16 million respectively, although the latter was a debt financing round.

Once considered among the top fundraisers in insurtech, UAE-based Hala, which had raised $7 million in funding, announced earlier this year that it would indefinitely cease its operations.

Given how specialised the insurance market is, raising funds becomes a challenging feat for startups, who prefer to raise funds and strategically work with investors with an insurance background.

For Flynn, encouraging insurance incumbents to invest in VC funds is essential to attract more funding into insurtechs.

“I think the single most important thing that could happen is to encourage insurance companies to participate in VC activities by giving them some sort of discount against the fees from the regulator or to give them some sort of exemption on a risk charge,” he explains.

Globally, half of the funding allocated to insurtechs goes to SaaS products. In the region, a growing cohort of startups have come into the space to help incumbents digitise their processes and have managed to garner investor interest. But overall, the volume of investments is likely to stay modest, as the scope of insurtechs remains limited to a very small part of the value chain, which means that their potential for growth is also limited.