Mena startups raised $101 million in August 2023

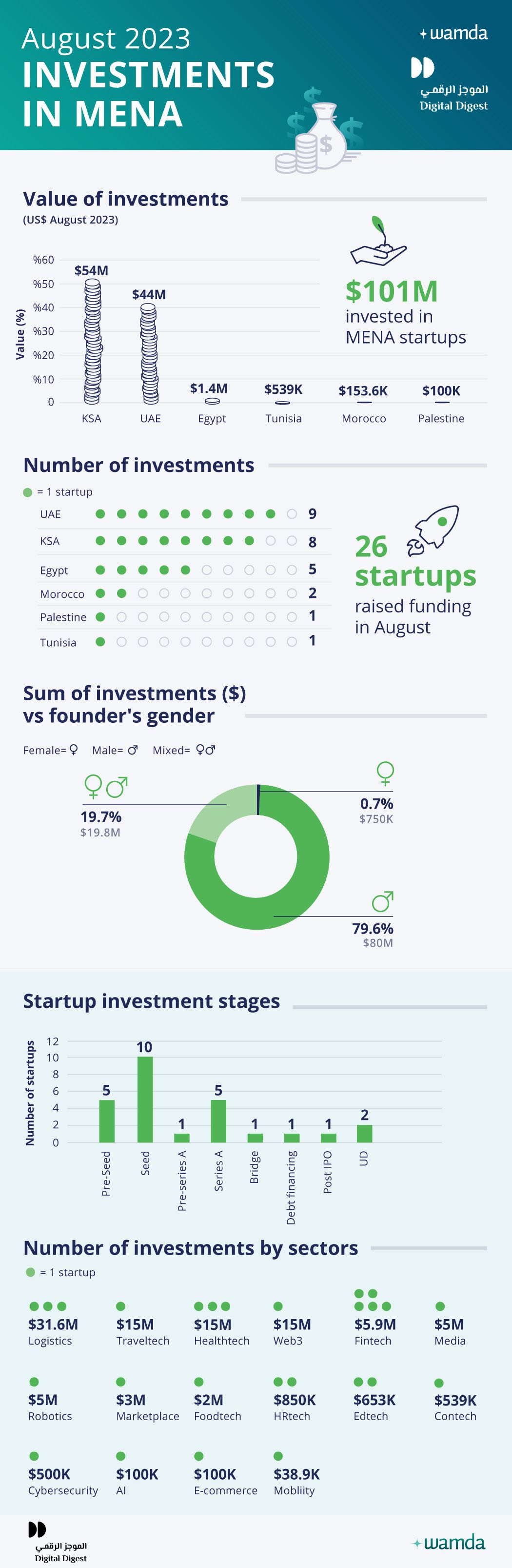

Startups in the Middle East and North Africa region (Mena) raised $101 million across 26 deals, a six per cent increase month-on-month in terms of deal value. Year-on-year, the funding amount suffered a steeper 73 per cent decline.

Saudi Arabia led in the total funding raised last month, with $54 million raised across eight deals. The top fundraisers were inventory management platform Rewaa and traveltech FlyAkeed, which secured $27 million and $15.2 million, respectively. Coming in second was the UAE, whose startups attracted $44 million spread over nine deals. Both countries accounted for 97 per cent of the total funds raised in August.

Egypt was a distant third at $1.5 million, with HR-tech startup Talents Arena being the largest beneficiary with its $750,000 round. Tunisia, Morocco, and Palestine took the fourth, fifth, and sixth ranks.

When it comes to sector funding, logistics bagged the most capital with $36 million, thanks primarily to Rewaa’s Series A round. This was followed by traveltech, healthtech, and Web3. These four sectors were the most funded, contributing 76 pe rcent of the total funding received in August.

Fintech slipped to the fifth position funding-wise but topped the charts in terms of deal count. Within fintech, wealthtech startups garnerd the most investor traction.

The increase in funding last month was mostly led by early-stage rounds. Stage-wise, startups at the Series A stage clinched more than 63 percent of the investment, while seed-stage startups scooped up the deal volume with 10 deals. Notably, the Beriut-born and UAE-based Anghmai completed a post-IPO raise worth $5 million from SRMG Ventures, a year and a half after it listed on the NASDAQ.

B2B startups dominated the funding landscape, representing more than half of the funding raised in August, while their consumer-facing counterparts raised 27 per cent across nine deals. B2B2C startups raised the remaining 17 per cent.

Out of 26 deals, only six attracted direct foreign investment. Regionally, UAE-based investors were the most active, participating in 10 rounds, while Saudi Arabian investors were the second most active, participating in nine deals.

Of the $101 million, only $20 million went to statups that have at least one female co-founder. The deal participation tilted towards male-founded startups, which attracted 80 per cent of total amount raised in August. Just one female-founded startup raised investment last month - Egypt’s Talents Arena.

Key developments

Last month saw a flurry of fund launches and initiatives. The list counts the launch of the XceleRise scale up programme by Endeavour Egypt, a $200 million fund by Crown Prince Mohammed bin Salman to invest in Saudi and foreign deepttech startups, and Singapore’s Antler’s $60 million Menap-focused fund.

A couple of the initiatives were geared towards Palestinian founders and entrepreneurs, including Google’s capacity building programme to support Palestinian tech entrepreneurs and Pelest Angels.

Additionally, a couple of acquisitions were recorded last month as IoT solutions provider Machinestalk was acquired by IoT Squared as part of the latter's plans to shore up its presence in the Saudi market and Egyptian B2B pharmaceutical marketplace Auto-Cure was acquired by its compatriot Grinta.

Startups that did not disclose the amount they raised include Wadaie, Sl3ti, Lyvely, Rology, Lumi Ai, HEDG, and DataQueue. We assigned them a conservative amount of $100,000 in funding.

These monthly reports are a collaboration between Wamda and Digital Digest.