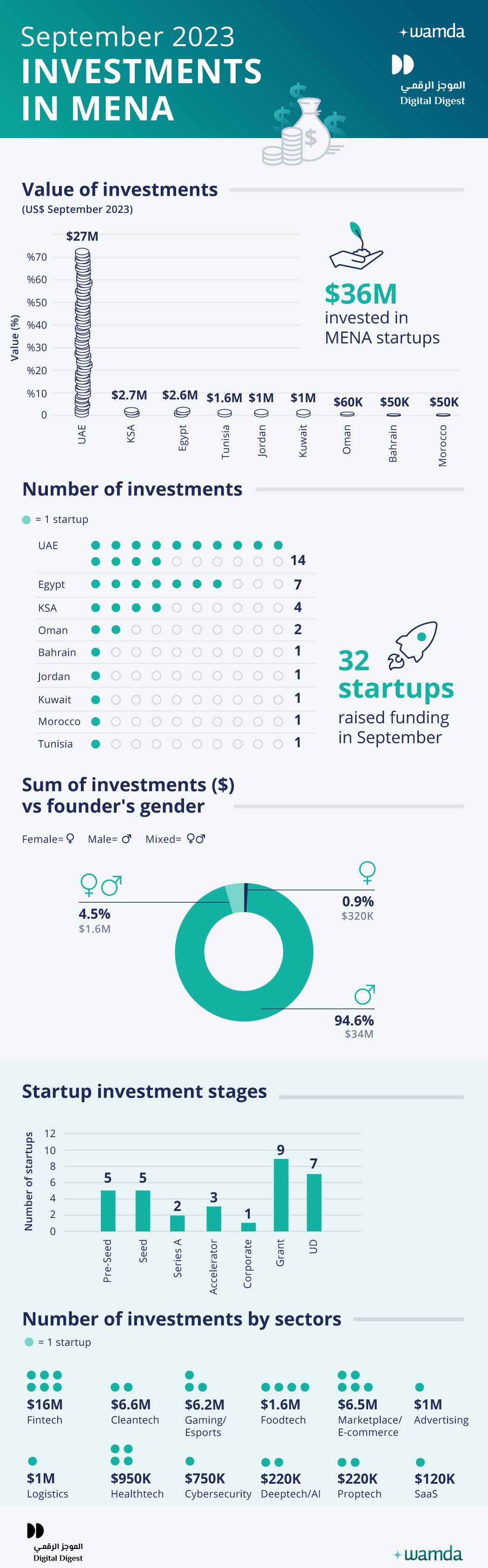

Mena startups raised $36 million in September 2023

Startups in the Middle East and North Africa raised $36 million in September across 36 deals, a 64 per cent drop in value month-on-month and a decrease of 82 per cent year-on-year. This pushes the total amount raised so far this year to $1.8 billion of which $687 million is from debt financing. In the first nine months of 2022, startups in the region had raised $2.7 billion, of which $455,710,000 was debt financing.

The pinch in funding is being felt across the entire region, with deal count falling and cheque sizes also diminishing. The largest funding round last month was Fuze’s $14 million Seed round followed by the $5 million raised by Zero Carbon Ventures, both based in the UAE. It was primarily down to these two deals that the UAE was propelled to the top spot in terms of deal value, with its startups raising $27 million across 14 deals.

In terms of deal value, Saudi Arabia came second with $2.7 million raised across seven deals, while six Egyptian startups raised $2.6 million. Month-on-month, the slowdown in investment in Saudi Arabia has been the most dramatic, with a 95 per cent decline in deal value. After enjoying a buoyant year when compared to the rest of the region, it seems the investor hesitancy seen elsewhere has finally hit Saudi Arabia.

Sector-wise, fintech continues to draw in the most investment with six deals valued at over $16 million followed by cleantech and gaming. In terms of business model, the amount invested in B2B startups exceeded $25 million while B2C startups brought in a little over $10 million. However, deal count between the two was split equally. When analysing the deals through a gender lens, the results are as ever, disappointing. Seven startups founded by women raised $320,000, of which almost all were grants. Startups co-founded by men and women raised $1.65 million across four deals while startups founded by men raised $34 million across 21 deals.

The average ticket size was a little over $1 million last month, compared to $3.4 million in September 2022.

Four startups did not disclose how much they raised last they month, they were Ibreez, SoumTech, Widebot and Digizag. We assigned the first three a conservative sum of $100,000 each and $1 million for Digizag’s Series A round.

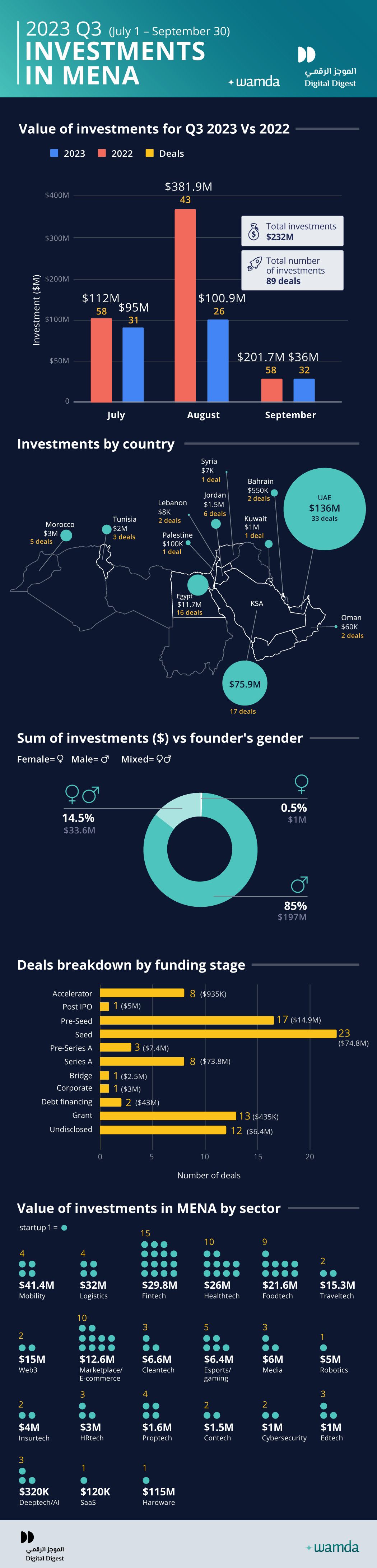

Third quarter

Taking a closer look at third quarter investments, deal value dropped by almost 67 per cent when compared to the third quarter of 2022, while deal count dropped by 44 per cent from 159 deals to just 89. The country impacted the most is Egypt with an 89 per cent drop in investment value, while Saudi Arabia saw its investment level decrease by 65 per cent and the UAE faced a 64 per cent decline.

These monthly reports are a collaboration between Wamda and Digital Digest.