4 lessons on scaling from 2014's MENA ICT Forum

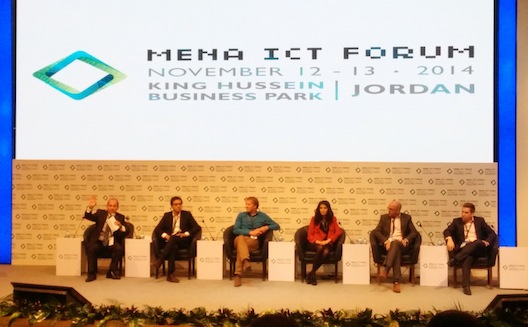

Last week, Amman’s King Hussein Business Park played host to the 2014 edition of the MENA ICT Forum, a two-day event that brought together leading figures from the regional and international ICT and startup communities. The forum featured a diverse series of panel discussions, speakers, seminars, and workshops that offered insights into everything ICT and entrepreneurship, from gaming and clean energy, to crowdfunding platforms and the future of venture capital investment in the region.

The business park’s campus-like structure made for a nice setting for the event, as attendees made their way between buildings and networked in the outdoor seating area. Perhaps the best aspect of the Forum was its balanced mix of intimate lectures, hands-on workshops, and large panel discussions. There was always an interesting session to attend, whether it be a one-on-one chat between Hala Fadel and Khaled Ismail at the Endeavor Space, a JoAnimate workshop or Wamda Roundtable, or panel discussion with some of the world’s leading female angel investors.

From the many sessions I attended, the recurring theme seemed to be that both Jordan and the wider region have immense potential in the ICT sector, but that continued diligence, learning, innovation, and patience are required in order for that potential to be reached.

The sheer amount of knowledge and information shared at the event was rather overwhelming and certainly cannot be captured by this recap. However, I have distilled four valuable lessons and insights from four of my favorite quotes from the sessions that I attended. Here they are:

1. Look for startup opportunities outside the realm of apps and mobile, and focus on entrepreneurial endeavors aimed at solving chronic societal issues.

“The lesson I learned is that

technology has a low barrier to entry, but it’s a [vast] blue

ocean, particularly apps and mobile…it’s very tough…and I look at

Egypt and I say there are zillions of problems. Guys, be

innovative, be entrepreneurial, go and solve the garbage problem,

go and solve the healthcare problem, go and solve the education

problem, and by doing so you’re an entrepreneur, you’re doing

something for the country, and you’re going to make tons of money

because nobody is competing with you, as opposed to mobile apps. So

over time I started investing more and more into companies that

have really applied innovative yet simple solutions for existing

chronic problems in Egypt.” – Khaled Ismail, founder &

Chairman, Klangel; head of Entrepreneurship

and Innovation Program at AUC

“The lesson I learned is that

technology has a low barrier to entry, but it’s a [vast] blue

ocean, particularly apps and mobile…it’s very tough…and I look at

Egypt and I say there are zillions of problems. Guys, be

innovative, be entrepreneurial, go and solve the garbage problem,

go and solve the healthcare problem, go and solve the education

problem, and by doing so you’re an entrepreneur, you’re doing

something for the country, and you’re going to make tons of money

because nobody is competing with you, as opposed to mobile apps. So

over time I started investing more and more into companies that

have really applied innovative yet simple solutions for existing

chronic problems in Egypt.” – Khaled Ismail, founder &

Chairman, Klangel; head of Entrepreneurship

and Innovation Program at AUC

2. Due to a dearth of adequate “skilling” options, the education industry is an especially ripe area to launch a startup.

“If you’re looking for an area

where you’re considering a startup, education is a great one, and

the reason is this: when we actually get all this information

[about the holes in skills training resources/options] and as we

get deeper and deeper information that we can graph, I will

guarantee you that most of the skills that are required in the

world do not actually have anyone who’s teaching them. In other

words, there really aren’t any resources for learning a lot of the

topics that actually matter out there… So now is the time, if you

want to be innovative, be innovating in the world of education

because not only is this information going to be coming online but

also the need for skilling is only going to go up over time.”

– Allen Blue, cofounder & VP Product Management, LinkedIn

“If you’re looking for an area

where you’re considering a startup, education is a great one, and

the reason is this: when we actually get all this information

[about the holes in skills training resources/options] and as we

get deeper and deeper information that we can graph, I will

guarantee you that most of the skills that are required in the

world do not actually have anyone who’s teaching them. In other

words, there really aren’t any resources for learning a lot of the

topics that actually matter out there… So now is the time, if you

want to be innovative, be innovating in the world of education

because not only is this information going to be coming online but

also the need for skilling is only going to go up over time.”

– Allen Blue, cofounder & VP Product Management, LinkedIn

3. Utilize the notion of “return on involvement” to help you select the ideal crowdfunding model to raise funds for your project.

“As an entrepreneur, to know what kind of money

you want to raise [is important]; if you [should] go for reward- or

equity-based platforms or debt-based peer-to-peer lending you need

to think about your investor. What is the reason that the investor

wants to invest in you? How I normally explain it is through

crowdfunding ROI. It’s not the traditional return on investment,

because the crowdfunding investor wants to be involved, wants to

have a direct role in the company he’s investing in. So it is a

return on involvement, and that return can either be social return,

material return, or financial return.” – Ronald

Kleverlaan, Vice Chairman, European Crowdfunding

Network; founder, CrowdfundingHub

“As an entrepreneur, to know what kind of money

you want to raise [is important]; if you [should] go for reward- or

equity-based platforms or debt-based peer-to-peer lending you need

to think about your investor. What is the reason that the investor

wants to invest in you? How I normally explain it is through

crowdfunding ROI. It’s not the traditional return on investment,

because the crowdfunding investor wants to be involved, wants to

have a direct role in the company he’s investing in. So it is a

return on involvement, and that return can either be social return,

material return, or financial return.” – Ronald

Kleverlaan, Vice Chairman, European Crowdfunding

Network; founder, CrowdfundingHub

Kleverlaan went on to explain that if investors are seeking a social return, entrepreneurs should use donation-based platforms. If they are seeking material returns, they should employ reward-based models. Lastly, if they are seeking financial returns, equity-based or peer-to-peer lending models are best suited.

4. Women are vital to unlocking the full potential of any economy or ecosystem.

“I have spent much of my

professional life trying to encourage women to become

entrepreneurs, leaders, and investors. It would be easy for you to

think that I do this as a woman, and I do it because I’m a woman.

But actually that’s not why I started, I started because I had the

interest to really fuel the Icelandic economy when I returned after

10 years in the US back to my home country, and I really believed,

based on my experience in the United States, that to really fuel an

economy is to use all of its resources, and today I actually call

women the largest renewable resource of Iceland and Scandinavia

because its actually economic power that we’re talking about. I

have learned that it’s also about positive impact because when you

empower women you get the extra benefit, you make more money and

your economy grows, but you actually build better societies.”

– Halla Tomasdottir, Icelandic angel investor; founder,

Sisters Capital

“I have spent much of my

professional life trying to encourage women to become

entrepreneurs, leaders, and investors. It would be easy for you to

think that I do this as a woman, and I do it because I’m a woman.

But actually that’s not why I started, I started because I had the

interest to really fuel the Icelandic economy when I returned after

10 years in the US back to my home country, and I really believed,

based on my experience in the United States, that to really fuel an

economy is to use all of its resources, and today I actually call

women the largest renewable resource of Iceland and Scandinavia

because its actually economic power that we’re talking about. I

have learned that it’s also about positive impact because when you

empower women you get the extra benefit, you make more money and

your economy grows, but you actually build better societies.”

– Halla Tomasdottir, Icelandic angel investor; founder,

Sisters Capital