Could MENA see a unicorn soon?

Extinct

in the wild in the 1970s and reintroduced in the 1980s, the Arabian

Oryx may be the animal closest to a unicorn. (Image via

Americanbedu.com)

Does MENA have what it takes to add to the global unicorn club?

Unicorns, in the four-legged horse-like horned sense of the word, are mythical creatures of folklore. You can’t actually find one; this has been tested and it is known.

However, private companies that achieve a valuation of $1 billion or more, become legends of another kind, albeit with the same name: Unicorns.

These companies are the high-impact, hyper-growth, game-changing disruptors that we savor as the most valuable startups in existence. They’re companies like Uber ($51 billion), Xiaomi ($46 billion), Airbnb ($25 billion), Palantir ($20 billion), Didi Kuaidi ($15 billion), SpaceX ($12 billion), and more.

According to CB Insights, over 150 unicorns are roaming the startup-stratosphere. There are only 14 “decacorns” right now, or private companies valued at $10 billion or more.

Let’s have a look at what we know about creating unicorns, where they come from, and what industries they’re in, and where MENA stands in the race for a billion-dollar startup.

Unicorns are extremely rare

According to CB Insights only about 1 percent of privately held companies on the planet become unicorns, andof the 4,000 companies that raised their first funding round in 2014, only 6 earned the title. That’s a conversion rate of a mere 0.15 percent. Furthermore, data from CB Insights suggests, startups that turn into unicorns are becoming increasingly rare. From 2008 to 2014, there were more companies raising first rounds each year, but fewer and fewer became unicorns.

In fact, over the last decade the number of companies raising angel, seed and Series A rounds increased by a compound annual growth rate (CAGR) of almost 16 percent. Whereas, the number of those companies turning into unicorns went down over the same time period, at negative CAGR of roughly 25 percent.

According to Spoke Intelligence and VB profiles, as presented by ventruebeat.com (which arguably use a broad definition of Unicorn), “the average Unicorn takes six years to build” and “it requires $95 million in funding to reach that exalted status”.

If you are an entrepreneur or an investor in MENA, think hard about these stats, as none of the world’s billion dollar startups have ever been from the region. But, never say never. There will be a first.

Startup ecosystems in emerging economies are contributing unicorns

The USA has the most unicorns, but startups are disrupting entrenched-markets like never before, and emerging economies that are outside the Organization for Economic Cooperation and Development (OECD) are in fact creating billion dollar companies.

Of the countries that have a portion of the world’s Unicorns, 35 percent are emerging economies that are outside of the OECD.

Despite the fact that emerging economies are growing Unicorns, MENA could be left out, as the region’s collective economic prospects are troubling. According to The World Bank, “economic growth in the Middle East and North Africa is stagnating, as low oil prices, conflicts, and the global economic downturn render short-term hopes for a tailwind unlikely.”

Certain industries are generating more Unicorns over others

Most of the world’s Unicorns are in the ecommerce or online marketplace industries. Interestingly, the drones and satellites industry is not on this list yet, but appears to be coming-of-age, according to CB Insights list of “50 Future Unicorns”.

Over half (51 percent) of the world’s Unicorns are concentrated in three industries: ecommerce and marketplaces, internet software & services, and fintech, respectively. That trend bodes well for MENA’s burgeoning internet-enabled businesses.

This is why a Unicorn could soon emerge in the region.

More internet users in MENA means more potential customers for online companies, and that could mean higher valuations for the region’s internet- startups. In the report, MENA’s Internet Industry: The Opportunity, Challenges, and Success Stories, it is said that MENA has over 140 million internet users, and the region’s internet penetration rate is fast approaching 50 percent. Also, mobile internet penetration in the region is roughly 25 percent and 72 percent of those users have 3G coverage. Notably, the United Arab Emirates and Saudi Arabia have two of the highest smartphone use rates in the world at 74 percent and 73 percent, respectively.

MENA has several prospects for a Unicorn. Prominent investors have signaled that MENA could see “mega-exits” and unicorns emerging within the next five years. Companies like Careem, a growing 'Uber-like' ride-sharing service in MENA, and Souq.com, the region’s biggest ecommerce startup are predicted to be among the the first Arab unicorns.

Many obstacles to a local Unicorn

Yet, a myriad of challenges stand in the way.

For a ride-sharing service like Careem, intense competition is apparent. In fact, Uber recently invested $250 million to expand services specifically in MENA. According to CrunchBase, Uber’s investment in the region more than triples all of Careem’s capital raised to date (exactly $71.1 million).

Other challenges to growing a company in MENA include those mentioned in a new Wamda Research Lab report, Country Insights: Exploring Trends and Challenges to Scale for Startups in Egypt, Jordan, Lebanon and the UAE. The WRL found that over 20 percent of surveyed entrepreneurs in the region’s major startup-hubs (Jordan, Egypt, Lebanon, UAE) said that their ability to generate revenue is held back by difficulties “collecting payments on goods or services sold”, among other barriers to scale.

For ecommerce companies in MENA, payments-challenges are particularly acute.

Payfort, MENA’s online payment-solutions company, recently concluded that: “Cash on delivery can be crippling for small ecommerce companies due to the costs and high return rates,” and “many firms are struggling to get to grips with this local challenge.”

Payfort says the top five challenges for online payments in the region are: customers’ trust on checkout, the existence of COD alternatives, the acceptance ratio for online transactions, the prevalence (and fear) of fraud, and limited online-payments options, respectively. Addressing these barriers for MENA’s ecommerce companies is imperative, and will undoubtedly increase the chances of seeing a unicorn in the region in the near future.

Bubbling interest from global 'Unicorn' investors

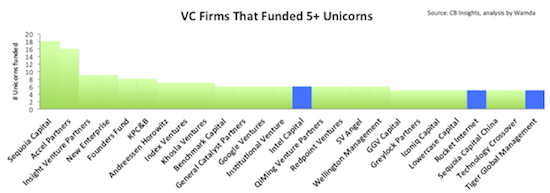

Despite challenges, prominent venture capital firms are investing in MENA’s startups. The VCs highlighted in blue in the chart below are already investing in the region.

Globally, there are 192 different investment firms that have participated in a total of 420 Unicorn-making investment deals to date. Some (35 percent) of the world’s unicorn-backers have participated in more than one billion-dollar investment round. Fewer (14 percent) have funded five or more. Only two VCs in the world have backed a unicorn more than 10 times: Silicon Valley based Sequoia Capital and Accel Partners, respectively.

At least three prominent Unicorn-backing VCs have internet-related investments in MENA, and all of them have funded five or more unicorns around the world. They are: Intel Capital, Rocket Internet, and Tiger Global Management. Notably, Google also has a presence in the region’s emerging startup ecosystem.

Intel Capital has been among the most active international VCs investing in MENA’s startups since at least 2009. The company provided funding to Jordan-based online networking site Jeeran, and web-based entertainment guide ShooFeeTV, as well as United Kingdom and Lebanon-based Nymgo. Intel also invested in several UAE based startups, and in Turkey including Grupanya, among others in the region.

Rocket Internet recently led the largest purchase of an internet company in the Middle East to date, Kuwait’s Talabat.

Tiger Global Management acquired UAE based Internet company Cobone, in 2013, and invested in Souq.com.

The majority of the world’s unicorn-backers (65 percent) have participated in just one unicorn-making deal. Notably, that group of one-time massive-ticket investors includes the Kuwait Investment Authority which helped push US based digital health company NantHealth to a $2 billion valuation this year.

MENA still has steep challenges to overcome that could prolong the wait until a Unicorn emerges here.

These challenges include but are not limited to: slowing regional economic growth, intense international competition in some industries, challenges with online-payments that limit growth for ecommerce startups, and a myriad of underdeveloped or non-existent policies to support further capital investments in the region’s startups, as well as stimulating the development of higher education systems that fuel startups with talented and ambitious entrepreneurs, to name a few.

For more information about the challenges that entrepreneurs face while growing their companies in the region and recommendations for addressing them, visit the Wamda Research Lab.

Certain indicators do bode well for the rise of a Unicorn in the near future.

The potential for ecommerce and online marketplaces as well as internet and software services industries to spawn a billion dollar startup in the region is apparent. Perhaps more importantly, MENA is witnessing a surge in support for high-potential and high-impact entrepreneurs. In recent years, new funds, accelerators, thought leaders and government policies have all contributed to improving conditions for the region’s startups. In fact, according to new research published by the WRL, the number of startup hubs in the region grew four-fold between 2010 and 2015.

This growing momentum will undoubtedly be channeled towards accelerating the rise of a Unicorn in MENA.