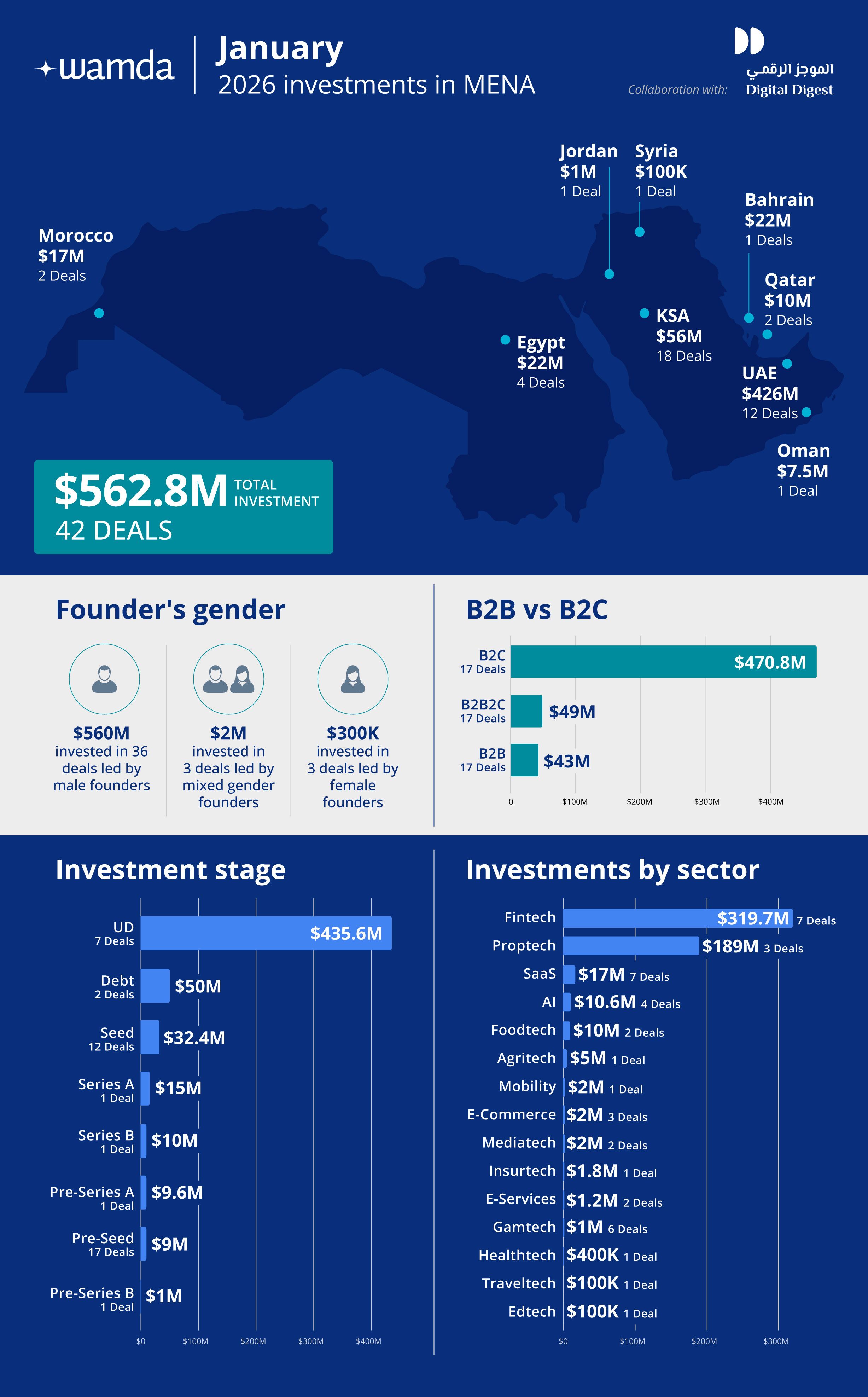

MENA startups raise $563 million in January 2026

Investment activity across the Middle East and North Africa (MENA) startup ecosystem picked up at the start of the year, with 42 MENA-based startups raising a combined $563 million in January 2026. The total represents a 228% increase month-on-month, while remaining 35% lower year-on-year. Debt financing played a limited role, accounting for 9% of the capital raised during the month.

UAE dominates regional funding

Funding concentration was evident at the country level. The UAE topped all MENA ecosystems in January, securing $426.3 million across 12 deals. This was driven primarily by two large transactions, including Mal’s $230 million deal and Property Finder’s $170 million round. Saudi Arabia followed, where 18 startups collectively raised $56 million, while Egypt ranked third with four startups securing a combined $22.1 million.

Fintech leads sector funding

Sector-wise, fintech led funding activity in January, with seven startups raising $319.7 million. Proptech followed, as three startups secured $189 million. Software-as-a-service (SaaS) startups ranked third, with seven of them raising a total of $17 million.

Early-stage startups dominate deal flow

The distribution of funding by stage continued to skew towards earlier companies. A total of 31 early-stage startups raised $66 million during the month. Only two later-stage deals were recorded, amounting to $11 million. The remaining capital was deployed into startups that did not disclose the stage at which they were raising.

B2C models capture the bulk of deployed capital

When viewed by business model, startups serving consumers directly attracted the majority of capital. Business-to-consumer (B2C) startups raised $470.8 million across 17 deals. Business-to-business (B2B) startups recorded 19 transactions worth $43 million, while hybrid B2B2C models raised $9 million across six deals.

Gender gap in funding persists

Capital distribution based on founder gender remained uneven. Male-founded startups accounted for 36 deals and raised a combined $560 million. Startups founded solely by women raised $300,000 across three deals, while mixed-gender founding teams secured $2.2 million across three transactions.