Growth-stage companies in Mena face $20 billion funding gap

Growth-stage funding in the Middle East and North Africa region (Mena) faces a $20 billion gap, with only $4.2 billion VC dry powder available, according to a report by Saudi VC firm Saudi Technology Ventures (STV).

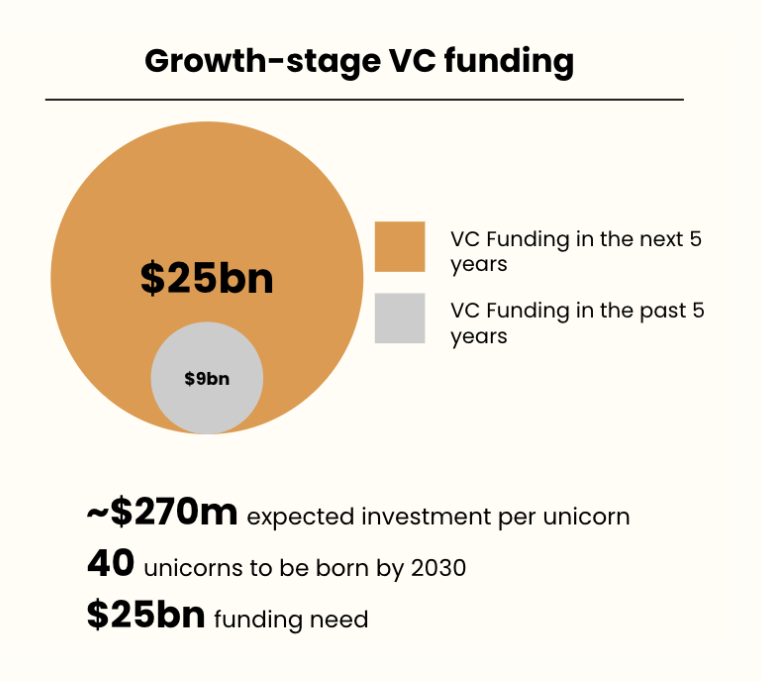

Based on a previous report by STV, the Mena region is expected to create 40 unicorns by 2030, requiring a total of $10.8 billion in funding. This data stacks up against a global benchmark, which sets the financing requirements to produce a unicorn at $270 million in funding. With a 40 per cent success rate for growth-stage companies raising much larger rounds, as further expected by STV, $25 billion in funding is needed to support the development of growth-stage companies.

VC-backed growth-stage companies need to have tenfold the amount of capital needed by their early-stage counterparts. The scarcity of funding allocated to growth-stage companies requires the presence of at least 10 VC funds dedicated to late-stage funding in the market, the STV report suggests.

The growth-stage-focused VC funds have to sit on at least $300 million of capital commitments to be able to allocate up to $45 million to each portfolio company, giving them the ability to lead rounds larger than $100 million, the report stated.

But the overall drop in funding witnessed in the first half of 2023 is likely to have a chilling effect on the evolution of growth-stage companies; Funding activity in H1 '2023 plunged by more than 46 per cent year on year.

The funding crunch brought on by tightening monetary policies around the globe in light of the ongoing war in Ukraine carried over from the preceding year. Demonstrably, VC funds redirected their focus to support existing portfolio companies and refrained from making further commitments to other companies under shaky market conditions. This, on the one hand, continues to widen the gap in funding that is flowing into growth-stage companies, and on the other hand, has made global investors wary of making further commitments to regional startups.

The STV data points to the fact that global investors accounted for 50 per cent of investors participating in late-stage deals in Mena startups. This figure dropped to 28 per cent in the first half of 2023.

On the upside, the Mena ecosystem boasts a strong pipeline of growth-stage companies, with around 220 startups recorded as having at least raised a Series A round. The report mentions that the number of rounds that are larger than $30 million has grown from five in 2020 to 22 in 2022 and that mega-rounds that are larger than $100 million are on the rise, as Series C rounds become more frequent.

Additionally, the pace of exits increased in the period from 2018 to 2022, which saw 190 acquisitions, the report highlighted, adding that startups in Mena typically take eight years from startup to exit. So far, around four companies have gone public, with others unveiling plans to file for an IPO, including several STV portfolio companies such as Tabby, Floward, Trukker, and Unifonic.

Typically, growth-stage-focused funds source large amounts of capital, primarily from institutional investors. The challenge lies in the fact that the latter requires ”rigid internal policies that prioritise capital allocation to funds showing a proven track record in terms of exits”.

“Such a track record is not available for Mena growth-stage funds, simply because the industry is still too young. The lack of a track record on exits discourages private investors from deploying capital into growth-stage funds,” the report adds.

From there, STV strongly emphasises the critical role the public sector should play in making more funds available to growth-stage companies.

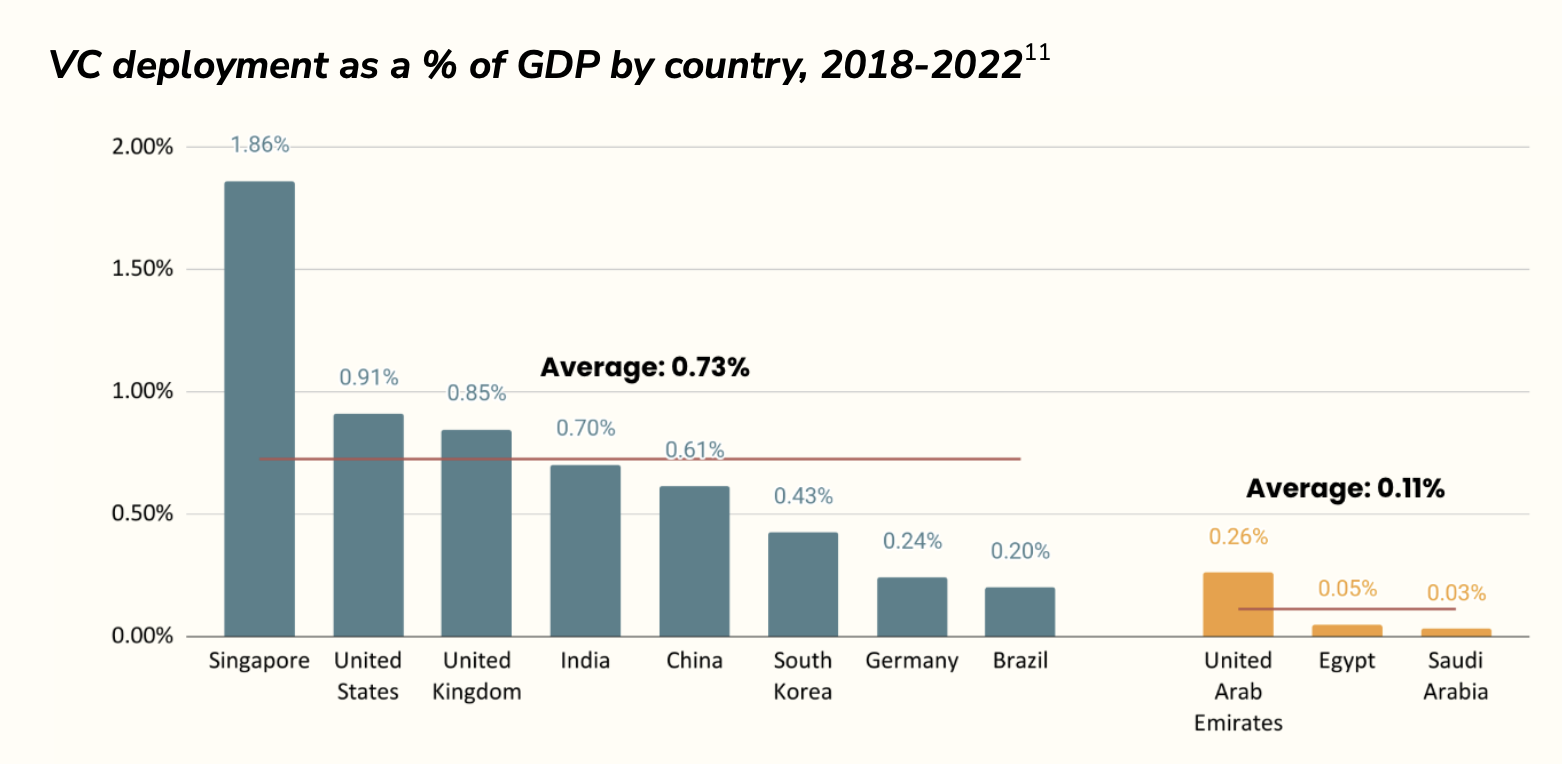

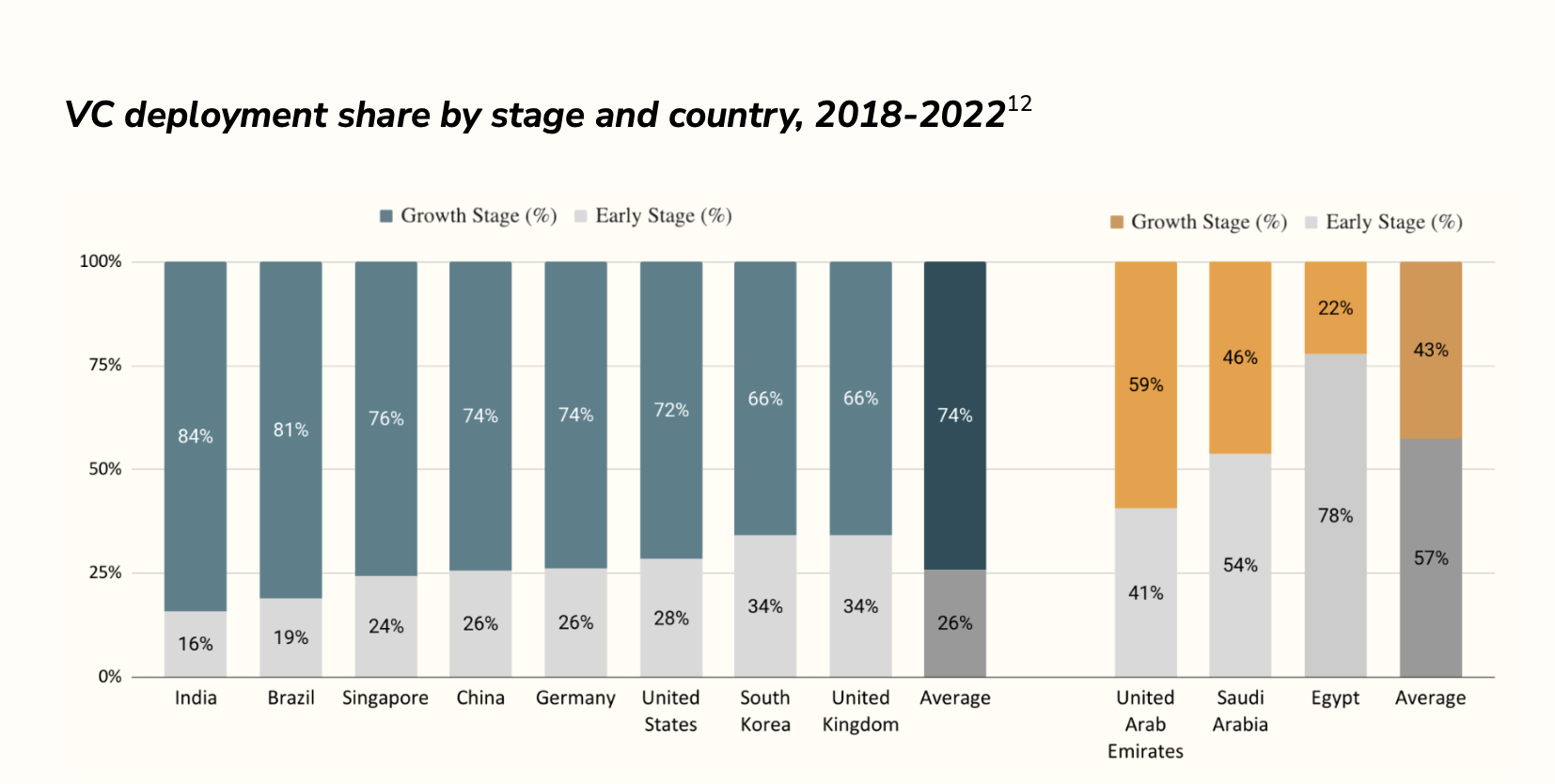

The VC funding and GDP ratio of the three Mena countries with the highest VC activity, namely the UAE, Saudi Arabia, and Egypt, stands at only 0.11 per cent, with their share of growth-stage capital contributing 43 per cent.

From the period 2018-2022, the UAE attracted the largest growth funding in Mena, representing 59 per cent of the VC activity in the country. That was followed by Saudi Arabia with 46 per cent and Egypt with 22 per cent.

Meanwhile, the average yearly deployment of VC capital varies between 0.2 and 1.0 per cent of the gross domestic product (GDP) of countries where the VC sector is more developed. In some countries, the share of capital directed towards growth-stage companies can be as high as 84 per cent such as India.

The STV report also predicts that the VC deployment to GDP ratio in Mena will reach 0.33 per cent in 2028, with the share of early-stage and growth-stage being 25 per cent and 75 per cent respectively.

Given that, the ecosystem needs the deployment of $39 billion in VC funding between 2023 and 2028, of which $13 billion should be invested in early-stage companies and $26 billion directed towards growth-stage funding, the report concludes.

Launched in 2018 by Abdulrahman Tarabzouni, STV is considered the largest VC fund in the region, with almost $1 billion in committed capital.

Earlier this year, STV announced the launch of its Total Growth platform, anchored by Saudi Arabia’s National Technology Development Programme (NTDP), to accelerate the growth of technology companies in the region through both equity and debt financing.