Can small payments lead to big business?

This article is a crosspost with the Payfort blog.

There was a time when the motto of the internet was “information wants to be free." But with more and more companies looking to cut out advertisers and generate revenue directly, money is becoming a fundamental aspect of navigating the internet. This has left many consumers looking for a new kind of payment platform, one that empowers them to pay smaller amounts and get exactly the content they want.

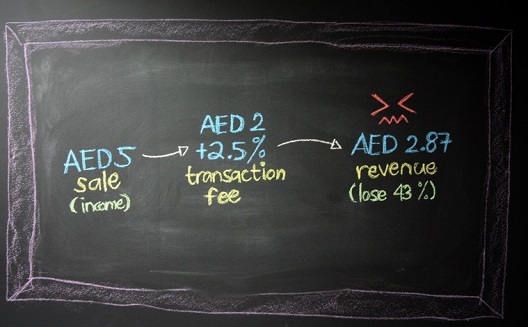

Welcome to the world of ‘micropayments,' a new type of à la carte consumption where small transactions are going to have a big impact. Micropayments is a term that describes the transfer of very small amounts of money, amounts that have traditionally been too small to be charged to a credit card. These transactions, though they could be incredibly frequent, see the majority of their value evaporate instantly because of the associated transaction fees.

The need for new payment platforms has led to an explosion of innovative micropayment strategies that aim to reduce transaction fees and make even the smallest transfers profitable.

There are three major drivers that are responsible for pushing the micropayment industry to new heights:

- The rapid growth of digital content, particularly digital media such as news, music, videos, etc.

- Exponential growth within the mobile app industry and the accompanying in-app marketplaces.

- The growth of social networks and online gaming communities with their own ‘microeconomies’ (small value credits, in-game products, virtual currency, etc.)

The above business models all rely on high volume - low value transactions, the perfect match for micropayments. As a result a synergetic relationship has formed that has rapidly accelerated the adoption of various micropayment platforms.

Micropayments aren’t restricted to the digital world either. Recently the government of Ajman in partnership with PayFort, started offering an e-payment option for parking across the emirate. The new e-payment service replaces the manual method of using coins and shows that even real world micropayments, traditionally made with cash, are targets for new digital micropayment platforms.

As new business models develop, that aim to sell more products for less, the micropayment industry will grow to match it. Valued at $9.8 billion in 2013, and expected to grow to $13 billion in the next few years, there’s no doubt micropayments are going to be big business.