Is there hope for startups in the tourism sector?

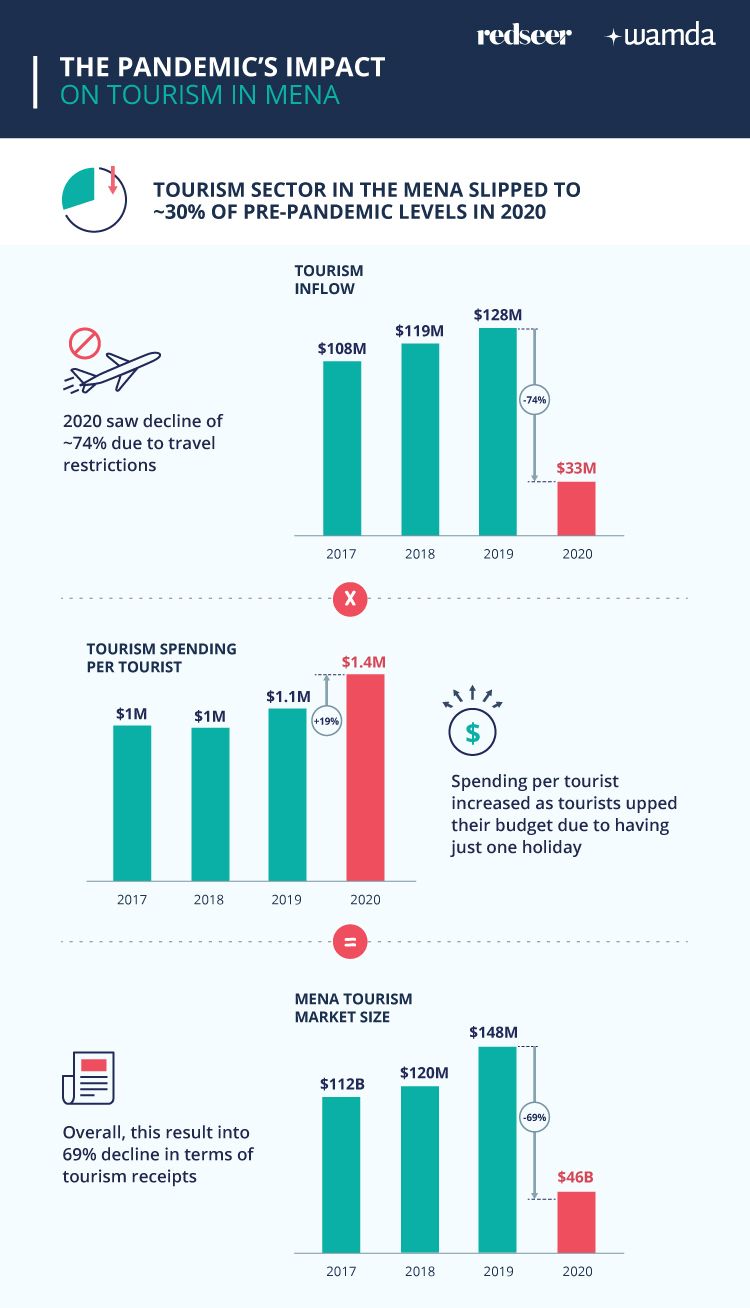

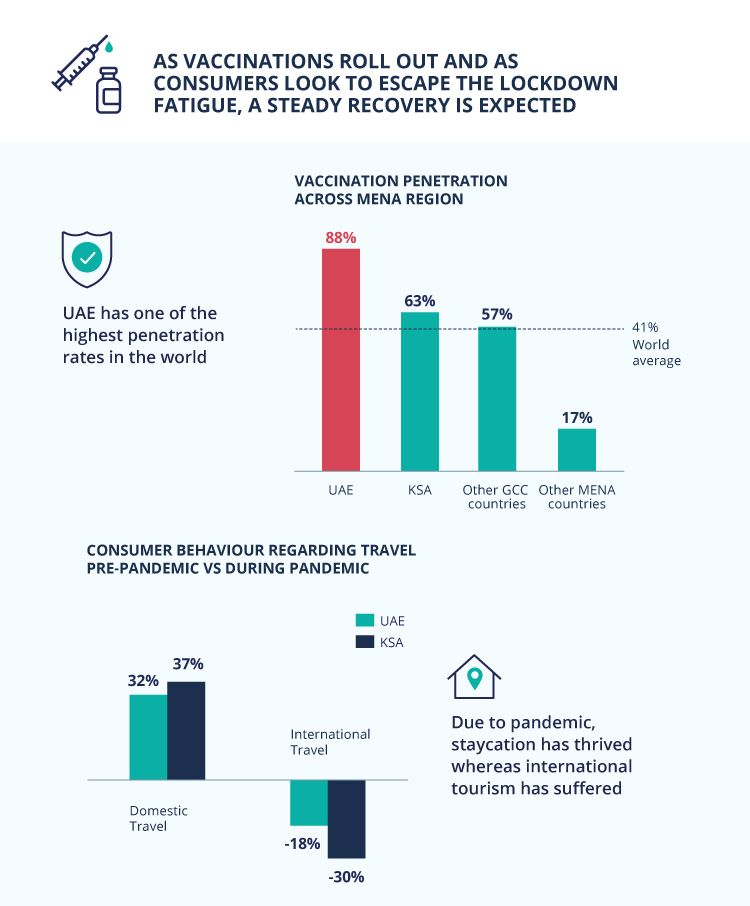

The accelerating pace of vaccination efforts worldwide has led to encouraging signs of recovery in the tourism industry, but as the virus continues to mutate, the fear of infection is still palpable, forcing travel operators and hospitality professionals to embrace physical-digital tourism, one that guarantees holidaymakers an enjoyable in-person and digital experience.

In that regard, leveraging technology in terms of improving operational efficiency and customer experience has become paramount to salvage the ailing industry and bring it back on its feet, especially in our region, where tourism is largely tied to the growing gig economy.

While tourism constitutes the biggest source of income for most Arab countries, the startup ecosystem in that space has been widely underserved with minimal VC activity. So far this year only four tourism and travel-related startups managed to raise a total investment of $8.7 million of which $6 million was invested in Saudi Arabia-based vacation rental platform Gathern.

But several new initiatives aimed at startups working in the tourism, hospitality and travel sector across the Middle East are attempting to change this and invigorate the space.

In the wake of the pandemic, Jordan-based venture capital firm VentureX has launched an industry-focused accelerator programme, including one on tourism in partnership with the Jordan Tourism Board (JTB).

“Jordan, like many other Arab countries, is very much involved in tourism,” says Yousef Hamidaddin, managing partner at VentureX. “It represents a big share of its local GDP [gross domestic product]. We decided to launch it as a response to the reset that the region went through and see whether or not we would get traction.

“We were not really clear about the response from both the investor network that might be interested in investing in this sector. We managed to onboard seven startups, helping them [with a] restructuring exercise and fit the nature of the reset that's happening in tourism.”

Through his work, Hamidaddin aims to connect startups with investors, corporations and other relevant stakeholders who might become early adopters of the startup’s solutions.

“Our thematic approach always requires validation partners, so the sector is the validating partner. The startup is coming to people from a specific destination or a location and telling them ‘I have the following solution - do you want to study its application within your facility? If you do, you're my first customer’,” he adds.

This year, VentureX launched another edition from its tourism-focused accelerator programme in Saudi Arabia in partnership with the General Authority for Small and Medium Enterprises (Monsh’aat), among several other themed accelerators. The VC has plans to launch similar programmes elsewhere across the region.

So far, the accelerator has received 25 applications from startups across the region. These include a platform that facilitates authentic, non-commercial interactions between tourists and local communities, an AI-powered social discovery platform for entertainment and city experiences, and a marketplace that offers travelers authentic travel experiences, to name a few.

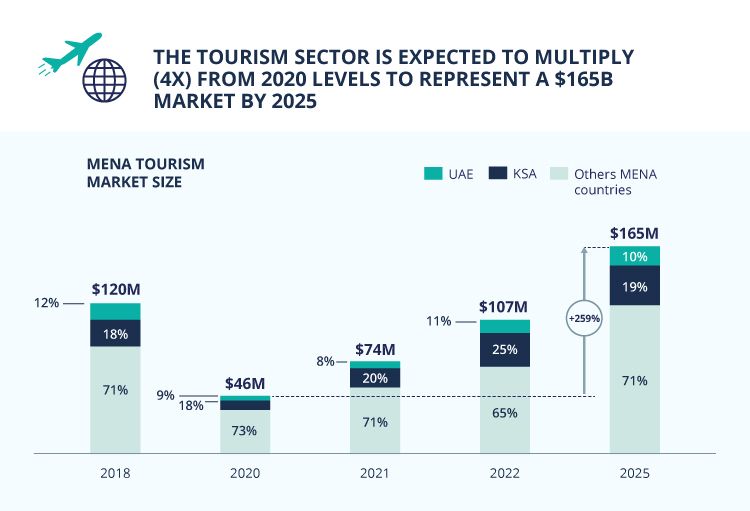

Prior to the Covid-19 pandemic, tourism accounted for 15 per cent of the GDP in countries like Jordan, Egypt, Morocco, Tunisia, according to the Institute of International Finance (IIF), which further predicted that tourism will most likely return to pre-Covid-19 levels in these countries by 2030 depending on vaccination rates.

Gulf countries are doing exceptionally well in terms of vaccination, therefore, outbound tourism in the GCC is set to bounce back quicker than the rest of the Middle East. During the Arab Market Travel Exhibition’s 2021 hybrid edition held in May in Dubai, Tim Clark, president of Emirates airline, expected a full recovery of airlines in the UAE by Q4 this year, in time for the Expo which is set to receive 25 million visitors over the next six months.

The Saudi government has recently put forth a national tourism strategy, aiming to increase tourism's direct contribution to its GDP to 10 per cent. Besides, the kingdom has ramped up investments in retail and several infrastructure projects in an effort to resuscitate outbound tourism after its earnings from Hajj and Umrah pilgrimages dwindled as a result of travel restrictions imposed by authorities in response to the Covid-19 crisis. In 2019, it was estimated that the kingdom's revenues from Hajj and Umrah pilgrimages reached $20 billion, comprising 20 per cent of its non-oil GDP. With a vast and varied landscape, the eventual return of pilgrims and several new tourist destinations in the pipeline, it is perhaps in Saudi Arabia where startups have the best potential to thrive.

Despite the overall drop in international travel, occupancy numbers in hotels in the region have risen, pushed by domestic tourism. This growth has enabled startups like UAE-based Fundok, a guest management platform for hotels and private rental properties, to expand. The startup, a graduate of the Wamda X programme, has grown some 300 per cent this past year and launched in Egypt earlier this month.

Fundok’s platform, accessible via browser and in-room tablets, provides fully digitised room and hotel guides, allowing guests to order hotel amenities and purchase from local services providers that are integrated into the platform.

“What people are really looking for is convenience,” says Mohamed Nassar, co-founder of Fundok. “No one wants to clutter their telephone or smart device with another app that they’re only going to use for five days. We’re looking at all these different technologies - the smart keys, the access cards for elevators, ordering online - [and provide] a way to link that all together in a manner that is seamless through a device and a complementary application that is not downloaded but an application you can access on demand.”

Yet, while startups like Fundok are innovating, digital transformation in the travel and tourism sector is moving at a slower pace compared to other sectors.

“In our industry, we have been quite traditional in the way we operate,” says Bani Haddad, CEO of UAE-based Aleph Hospitality Group. “Other industries have changed much faster than we have. While the hospitality industry has been and still is managed in a very traditional way, in many aspects, it's time for us to really catch up.”

Last month, Aleph launched its accelerator programme, with the aim of helping early-stage startups in the UAE improve their go-to-market efforts, quickly scale and validate their proof of concept to the group’s network of hotels.

“It is high time for us to start rethinking our model. We thought one of the best ways to achieve this is actually to bring in all these to bring in startups and new ideas and give them the opportunity to grow from here,” says Haddad.

Growing investor appetite

Investors are now willing more than ever to put weight behind new digital solutions and technologies that could make the hospitality experience as seamless as possible for the intended customers as well as the travel operator, argues Haddad, who further explains that the growing investor interest in such technologies was one of the key reasons why the company decided to press ahead with the launch of its accelerator programme.

“Technologies related to revenue management, pricing, distribution, have been put in place for a very long time, but when it comes to technology like artificial intelligence, that has not always been the case. Now, this has been accelerated,” says Haddad. “We have seen a number of investors who are eager to put their money in these in new technologies and new companies, we wanted to captalise on it.”

Bringing the industry back to its pre-Covid-19 levels hinges on the wide adoption of contactless technologies to minimise the risk of infection among travelers. While the hospitality industry has broadly adopted new technologies, few of these are focused on improving the customer experience itself.

“There are still a lot of touchpoints from the day you decide to go to a hotel, until the moment you leave the hotel, in terms of pre-booking, booking process, check-in and checkout, etc. All of these processes could probably become much easier, simpler, smoother, enjoyable for the consumer. That's one area, which I think can be improved,” says Haddad.

Echoing similar views, Hamidaddin says tech-based contactless solutions that go in line with physical distancing measures are currently gaining traction among the investor community.

“Investors from the sector are very much concreted with the shift to digital delivery. They're heavily consumed with getting back online, and therefore, looking or considering to look at novel ideas or new concepts,” says Hamidaddin.

Considering the consumer demographic shift in the travel industry, hotel managers and travel professionals should work on a bigger market of consumers, young travelers, recommends Haddad.

Localisation is key to scalability

One of the biggest challenges facing startups willing to make inroads is the need to work within an in person-environment and find alternate areas around the in-person experience.

“On one hand, there’s the challenge of trying to automate that whole process and create an experience out of it,” says Hamidaddin. “On the other hand, there’s the challenge of how to create solutions that can validate new experiences.”

Hamidaddin emphasises that localising experiences to different geographies and societies across the region can go a long way and be the stepping stone towards scalability and thus help startups maintain the needed resilience to survive.