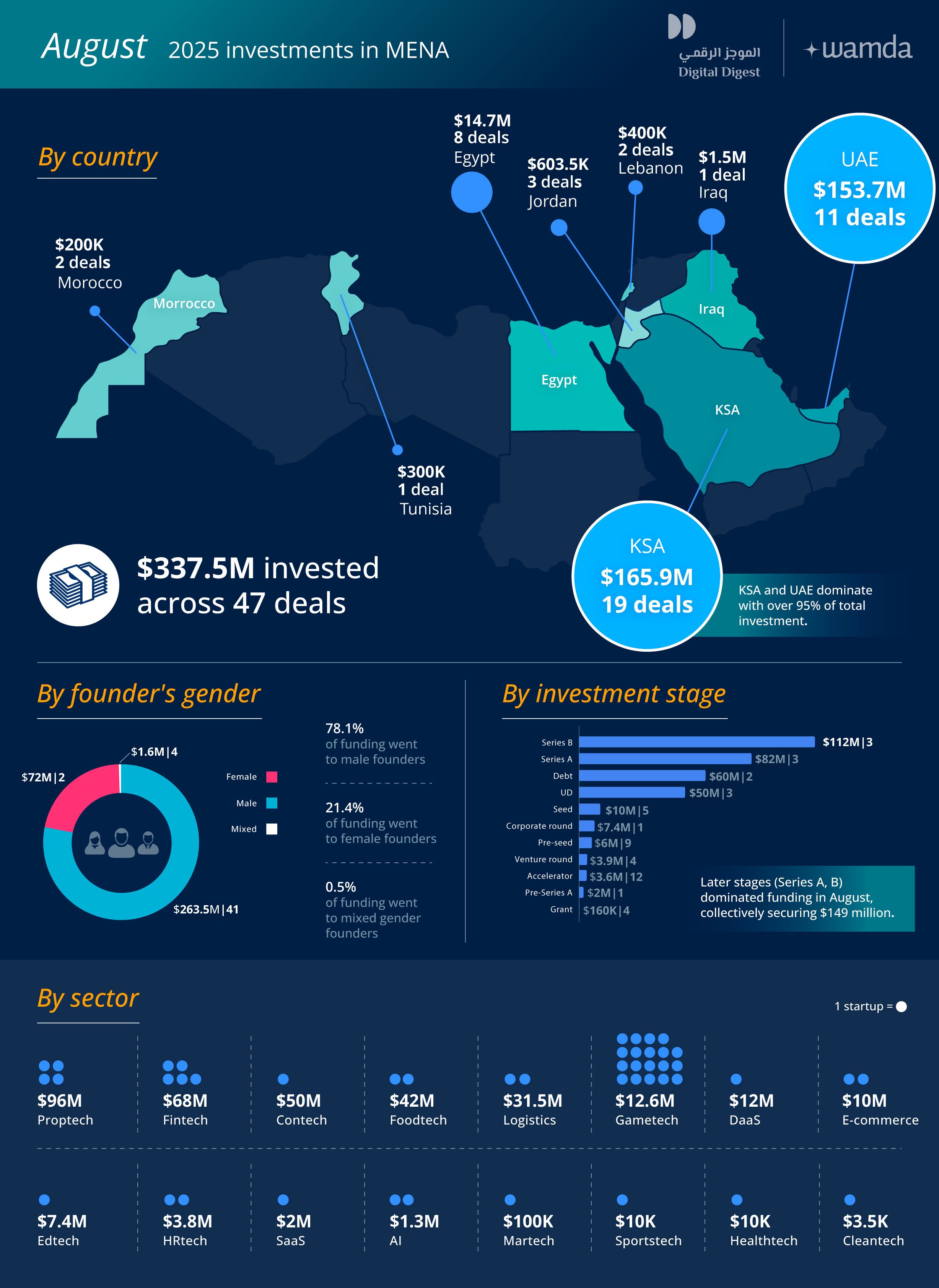

MENA startup funding drops to $337 million in August 2025, 74% higher YoY

Startup funding in the Middle East and North Africa fell sharply in August, with 47 startups raising $337.5 million. The figure is 57% down from July’s record $783 million but still 74% higher year-on-year. The pullback reflects a market recalibration after mega deals in July, with activity in August concentrated in Saudi Arabia and the UAE, and sector strength shifting toward proptech and contech.

Saudi Arabia and UAE dominate again

For the second consecutive month, Saudi Arabia led the region, attracting $166 million across 19 deals. The UAE followed closely with $154 million raised by 11 startups.

Egypt, a usual top-three player, continued to struggle, with just $14.7 million raised across eight startups. The ecosystem slipped further behind regional peers, extending the slowdown that began in July. Iraq, which had climbed to third place the previous month, also retreated to fifth with a single $1.5 million deal, while Morocco held on to a place in the top four.

Proptech leads, fintech rebounds

Proptech topped the charts, raising $96 million across four deals, underlining sustained appetite for real estate innovation. Fintech staged a recovery, ranking second with $68.3 million across five transactions.

Contech came third thanks to MYCRANE’s $50 million raise, while the gaming sector jumped into fifth. Saudi investors poured $12.6 million into gametech startups, signalling the Kingdom’s growing ambition to become a global hub for gaming and digital content.

Funding stages tilt to later stages

Later-stage activity dominated August. Three Series B deals raised $112 million, followed by three Series A deals worth $82 million. Debt financing contributed $60 million (18% of the total), while early-stage deals fell sharply, with 31 startups securing just $22 million. The data points to a more selective funding environment, with investors prioritising scale-ups over seed bets.

B2B startups regain the spotlight

B2B models reclaimed the lead, as 32 startups raised $180 million. B2C ventures secured $116.9 million across nine deals, with the remainder going to hybrid models. The tilt toward B2B suggests investors are leaning on revenue-driven models with clearer monetisation pathways.

Gender gap shows unusual spike

Funding remained male-dominated, with male-led startups securing $263.5 million across 41 deals. However, female-led ventures recorded a rare surge, raising $72.3 million across two deals — Gathern and Phys in Saudi Arabia. Mixed-gender founding teams attracted $1.6 million. While the overall gap persists, these deals mark a milestone for women entrepreneurs in the region.

These monthly reports are a collaboration between Wamda and Digital Digest.